- Home

- Tax Services

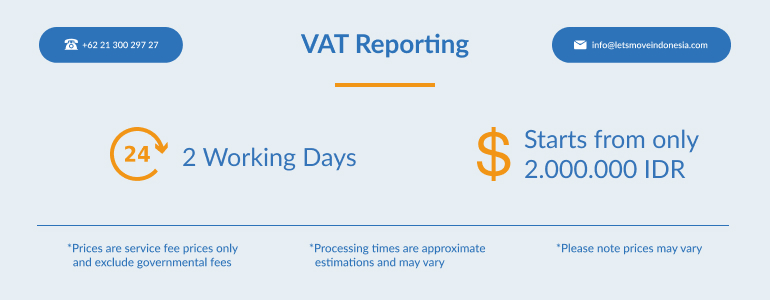

- VAT Reporting Service for Business

VAT Reporting Service for Business

Tax & Accountancy Services

- Share:

Monthly VAT Reporting is mandatory for all businesses that are VAT Registered in Indonesia and VAT is imposed on goods and services transactions carried out by entities or individuals.

Our experienced team will calculate your VAT obligation and report it to the tax office on your behalf.

What is Value Added Tax?

Value Added Tax (VAT) is a purchasing tax imposed on the value added at each stage of the production and distribution process. In Indonesia, the standard VAT rate is 11%.

VAT Registration in Indonesia

Value Added Tax (VAT) registration is a crucial step for businesses exceeding an annual revenue threshold of IDR 4.8 billion. This process ensures compliance with tax regulations and allows businesses to participate in the VAT system, collecting and remitting VAT on their taxable goods and services.

While the corporate VAT registration process can seem intricate, Lets Move Indonesia is here to simplify it for you. Our team of experts can guide you through the necessary steps, ensuring a smooth and efficient registration experience, allowing you to focus on your core business activities.

From gathering the required documents to submitting your application and obtaining your VAT certificate, we will be with you every step of the way. We’ll also assist in setting up your VAT account, enabling you to manage your VAT obligations effectively. With Lets Move Indonesia’s support, you can confidently navigate the VAT registration process and ensure your business remains compliant with Indonesian tax laws.

Our Business VAT Reporting and Tax Compliance includes:

- Submission of electronic Tax Invoice Serial Number

- Output tax invoice preparing and printing

- Monthly VAT Reporting preparing and submission to the tax authorities

- Assistance with ad hoc inquiries

Required Documents to Submit VAT Return

- EFIN number

- Invoices

- Copy of NPWP

- Active email address & phone number

Frequently Asked Questions

When is the deadline for submitting a VAT return?

The VAT return and payment must be submitted by the end of the following month after the taxable transaction occurred. For example, the VAT return for transactions in August should be submitted by the end of September.

How do I submit a VAT return in Indonesia?

VAT returns can be submitted online through the e-filing system provided by the Directorate General of Taxes (DGT) or manually at the local tax office.

What are the fines for late submission or payment of VAT?

Late submission incurs a fine of IDR 500,000, while late payment results in an additional 2% interest per month on the outstanding VAT amount.

What if I have a VAT refund?

If you have overpaid VAT, you can apply for a refund. The DGT will conduct a tax audit within 12 months of the refund application.

Can I amend a VAT return after submission?

Yes, you can amend a VAT return within the following two years of the original submission deadline.

What records do I need to keep for VAT purposes?

You must maintain proper records of all taxable transactions, including invoices, receipts, and other supporting documents.

What are the key components of a VAT return?

A VAT return includes details of output VAT (collected from customers), input VAT (paid to suppliers), and the resulting VAT payable or refundable.

Are there any exemptions or special VAT treatments in Indonesia?

Yes, certain goods and services are exempt from VAT or subject to special rates. It’s essential to understand these exemptions and treatments for accurate VAT reporting.

Fully inclusive Tax Filing & Accounting Solutions

Lets Move Indonesia is proud to offer a variety of exclusive Tax & Accountancy packages to ensure your business operates smoothly at a cost-effective price. To find out more about our packages,Click Here!

Have a question about our Tax & Accountancy services? Then contact the Lets Move Indonesia team for your free 1-hour consultation T: 021 300 297 27 E: [email protected] or visit us in the Lets Move Indonesia office, located in The Bellagio Mall, Mega Kuningan – The only walk in Agency in Jakarta!

Want to know more? Then check out these useful articles about Tax & Company Establishment in Indonesia!

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

Bali has become a top choice for foreigners to invest in real estate. But research on the property market can be tricky if you are unaware of the local laws and regulations. The good news is that buy a property in Bali is actually a possibility for foreign investors, yet there are regulations and rules on […]

Lets Move Indonesia

03/25/2025

Indonesia property market in 2025 is presenting a golden chance to investors. Rapidly growing economy, urbanization, and favorable government policies, now it is the right time to enter into this market. Let’s discover more about it. Current Trends in the Indonesia Property Market The Indonesian economic growth train on track with an annual increase rate […]

Lets Move Indonesia

03/25/2025

The Ministry of Finance (MoF) on October 18, 2024 introduced Regulation No. 81 (MoF-81) to streamline and develop different tax regulations. This was done in order to ensure that the new CoreTax Administration System (CoreTax) would be effective from 1 January 2025. This is a major reform effort that seeks to improve the effectiveness, reliability […]

Lets Move Indonesia

01/30/2025

17th of January, 2025 – Aligning with the regulation change in Indonesia regarding adjustments to the Penerimaan Negara Bukan Pajak (PNBP), or Non-Tax State Revenue in 2024, Lets Move Indonesia as the Indonesia announces a revised pricing structure for our comprehensive services. This adjustment isn’t simply a response to regulatory changes, it reflects a reaffirmation […]

Lets Move Indonesia

01/17/2025

Indonesia welcomed the inauguration of its membership in BRICS organisation after being announced by the 2025 Chair of BRICS, Brazil on Monday, (6/1/2025). Through the official statement, the Ministry of Foreign Affairs confirmed that the membership in BRICS represents a strategic step to strengthen democratic collaboration with other developing countries under the framework of inclusivity, […]

Lets Move Indonesia

01/12/2025

Indonesia’s tax system continues to play a pivotal role in supporting national development and achieving fiscal sustainability. However, enhancing tax revenue remains a significant challenge for the government, as annual targets consistently rise amidst various obstacles. As of 31 October 2024, Indonesia tax revenue reached IDR 1,517.5 trillion, approximately 76.3% of the State Budget (APBN) […]

Lets Move Indonesia

01/02/2025