Lets Move Indonesia

Welcome to Tax & Accountancy Services Indonesia

If you are looking for a partner to help you comply with Indonesia Tax and Accountancy Regulations, then welcome to Lets Move Indonesia.

Welcome to Tax Services Indonesia

If you live in Indonesia and need assistance to comply with tax reporting and consulting, then welcome to Tax and Accountancy Indonesia, underwritten by the market leading legal and tax agency, Lets Move Indonesia.

As one of the most vital elements in complying with Indonesia’s income rules, it is compulsory for individuals and corporates to report tax returns on a regular basis. Indonesia, as one of the tax-unfriendly nations, develops many tax-related regulations that are ever-changing. The presence of a tax consultant that retains business oriented mind and understands tax governance, will support as a business catalyst in developing and implementing the right tax strategies, as well as systems to minimize tax risks.

Lets Move Indonesia as The Most Reliable Tax and Accounting Consultancy in Indonesia offers a variety of tax services to improve your tax efficiency and work with you to develop inspired solutions for your tax situations. We serve individual and corporates, be it local and foreign companies in Indonesia and assist them with their tax compliance under the supervision of our Tax and Accountancy experts.

Why Trusting LetsMoveIndonesia with Your Tax Process

- The most cost-effective agency for your tax compliance

- The first agency to advertise the price transparently

- Awarded as "Most Trusted Visa & Legal Agency in Indonesia"

- The first agency that has 4 representative and accessible offices

- The most referred national agency for Tax Consulting Services

- Awarded the title "Best Visa & Business Consultancy Award"

Quick Highlights About Tax in Indonesia

About Monthly Tax Reporting in Indonesia

Monthly tax reporting is a tax obligation for business and certain individuals in Indonesia must submit to the Directorate General of Taxes (DGT) every month. The monthly tax return in Indonesia must come with a report that shows their personal or corporate has fulfilled the tax obligation.

This document must be filled out if the taxpayer has earned money from wages, salaries, dividends, interests, revenues or any other sources of income, and has been assigned a tax ID.

Individual and Corporate Tax

Both a local company and a foreign company with a permanent establishment in Indonesia are subject to a standard corporate income tax and can file a corporate tax return yearly.

Individual tax refers to the tax payable by an individual whose payroll is eligible for a tax payment. Tax rates for individuals in Indonesia ranges between 5% and 30% of income. Meanwhile, non-residents are subject to a 20% withholding tax of income received in Indonesia.

Some of Our Most Popular Tax Services Indonesia Products

Annual Corporate Tax Reporting

Obtain the best assistance in reporting Corporate Tax in Indonesia professionally.

Price starts from

IDR 10.000.000

Annual Individual Tax Reporting

Report your Individual Tax in Indonesia efficiently without hassle.

Price starts from

IDR 3.000.000

Monthly Payroll Services

Maintain your office payroll compliance organised and runs smoothly every month.

Price starts from

IDR 2.500.000

Required Documents to Report Tax in Indonesia

There are several documentation that should be submitted prior to tax reporting. Those are known as follow:

- Company’s Tax ID (NPWP) and its Registration Certificate (SKT).

- Any previous tax documents and their supporting materials (if any).

- Balance Sheet – Income Statement

- Comprehensive Financial Reports for the year

- List of prepaid payments, leases and their amortization

- General Ledger, and;

- List of Assets and associated depreciation.

Failure in Complying with Tax in Indonesia

If you fail to file your annual tax return on time, a 2% monthly interest will be charged on the tax payable. On top of that, you will be required to pay an administrative sanction fee of IDR 100,000 for a personal income tax return, or IDR 1,000,000 for a corporate income tax return.

For individuals who stay less than 183 days in a year in Indonesia, you are not obligated to file an income tax return in the country.

Meet Our Indonesia Team

Frequently asked questions

The PKP must upload tax invoices no later than the 15th of the following month after the tax invoice is issued, failing which it will be rejected by the DGT and therefore will not be considered as a tax invoice.

Mainly, there are two types of tax reports you should file in Indonesia. As an individual, you should adhere with individual tax reporting which can be done monthly or annually. If you have a business in Indonesia, submitting corporate tax report is compulsory. There are also more add on taxes following the two, you can contact our experts should you want to know which add on taxes you must file.

Yes, you should. However, there are certain different requirements from reporting tax for locals. Contact our experts for more further information.

To report tax in Indonesia, a company should provide documents as follow:

- Company’s Tax ID (NPWP) and its Registration Certificate (SKT).

- Any previous tax documents and their supporting materials (if any).

- Balance Sheet

- Income Statement

- Comprehensive Financial Reports for the year

- List of prepaid payments, leases and their amortization – General Ledger, and;

- List of Assets and associated depreciation.

LetsMoveIndonesia is widely regarded as the most reliable tax consultancy agency providing assistance to streamline your Indonesia tax reporting and accounting process.

No. But there are also certain conditions a PT or PMA should comply with in order to do tax reporting. You can contact our tax advisors through FREE consultations here.

Incomes That Are Included as Tax Objects

- The Indonesian personal taxation system is based on worldwide income. This includes:

Any salary paid to you for your current position, whether it be onshore or offshore - Dividend and interest income, both onshore and offshore

- Rental income both onshore and offshore

- Capital gains from sale of property, both offshore and onshore

How the Tax Services Process Works

Step 1

Book a free consultation by phone, video call or in one of our offices.

Step 2

We will listen to you individual requirements and provide the best solution to your business needs.

Step 3

Collect documentation and process.

Step 4

Our Tax Consultants will then make sure your tax reporting process runs smoothly.

Step 5

Provide you with the Tax Reporting documents.

Meet Some of Our Tax Advisors

Gary Joy

Gary Joy is the Founder of LetsMoveIndonesia and has a background as a Financial Advisor. Since founding LetsMoveIndonesia back in 2016, he has assisted hundreds of foreigners relocate, set up business and work within Indonesia.

Magelina Pieter

Magel is one of our most experienced Tax & legal professionals, who can also be found in our Jakarta office. Her expertise are firmly rooted in company registration and ensuring you comply with financial obligations.

Gusti Suma

Gusti can be found primarily in our Canggu Bali office; however, is often travelling around throughout Bali advising on Company Registration and Tax needs. As a qualified accountant primarily, Gusti has exemplary knowledge in both Legal and Tax related matters.

Frequently asked questions

Whether your business is undergoing hiatus or currently generating no profit, it is still mandatory to fulfill the tax compliance and submit monthly and annual tax reports even if your company does not have any business activities, thus zero taxes.

You cannot report tax when you do not have the id. However, there are also consequences of ignoring register yourself as an authorized taxpayer

Taxpayer Identification Number (NPWP) is known in Indonesia as Taxpayer Identification Number (NPWP). It is a set of numbers given to taxpayers (both individuals and corporations) as a personal identification in exercising their tax rights and obligations (i.e. Income Tax, and VAT). NPWP is given to eligible taxpayers who have fulfilled the subjective and objective requirements as stipulated in the tax laws and regulations.

Tax laws in Indonesia depend on whether the company employs foreigners. Some of the main taxes to be paid by foreign companies operating in Indonesia are personal income tax for employees in Indonesia, capital gains tax, withholding tax, payroll tax, business tax, and sales tax.

Tax planning with an expert consultant in Indonesia involves a comprehensive approach to optimize a client’s tax position while ensuring compliance with Indonesian tax regulations (pajak). It goes beyond simple tax preparation and aims to proactively identify opportunities for tax savings and mitigate potential risks.

Here’s what’s typically included in tax planning services in Indonesia:

- In-depth tax audit of the client financial situation

- Identification of tax-saving opportunities

- Development of a customized tax plan

- Proactive tax risk management

- Ongoing tax consultation and support

By partnering with a tax expert in Indonesia, you can gain peace of mind knowing that your tax affairs are being handled by professionals who are well-versed in the complexities of the Indonesian tax system. They can help you make informed decisions that can significantly impact your financial well-being.

Value Added Tax (VAT) is a 11% consumption tax imposed at every stage of production of both goods and services until the sale of the final product.

What are the consequences of not paying taxes?

Late payments attract interest penalties with a rate ensuing from the application of the MoF Interest Rate (MIR) plus additional charge.

Achieving a full comprehension regarding Tax and Accountancy in Indonesia is time-consuming. To cut the hassle, we suggest you to use the best tax services from reliable tax advisors who have ample of knowledge and experience assisting through any extend of tax process.

At Lets Move Indonesia, we help you not limited to providing tax reports, but also giving valuable insights and guidance for your tax compliance in Indonesia. Save more time and money by contacting our consultants now.

Lets Move Indonesia’s tax consultants handle hundreds of corporate and individual accounts every year with our efficient tax services. We have the best resources to help with your Tax and Accountancy affairs.

Our tax, visa, and legal consultants help thousands of worries about the visa application, business registration, and tax reporting processes be eliminated. We are proud to be the market leader in Visa and Market Entry services for both domestic and international cases, leading more and more people turn to Lets Move Indonesia to help with their tax and accounting needs due to our ethic and transparent price setting.

Latest News

Get to Know Latest Business & Visa Updates

Bali has become a top choice for foreigners to invest in real estate. But research on the property market can be tricky if you are unaware of the local laws and regulations. The good news is that buy a property in Bali is actually a possibility for foreign investors, yet there are regulations and rules on […]

Lets Move Indonesia

03/25/2025

Indonesia property market in 2025 is presenting a golden chance to investors. Rapidly growing economy, urbanization, and favorable government policies, now it is the right time to enter into this market. Let’s discover more about it. Current Trends in the Indonesia Property Market The Indonesian economic growth train on track with an annual increase rate […]

Lets Move Indonesia

03/25/2025

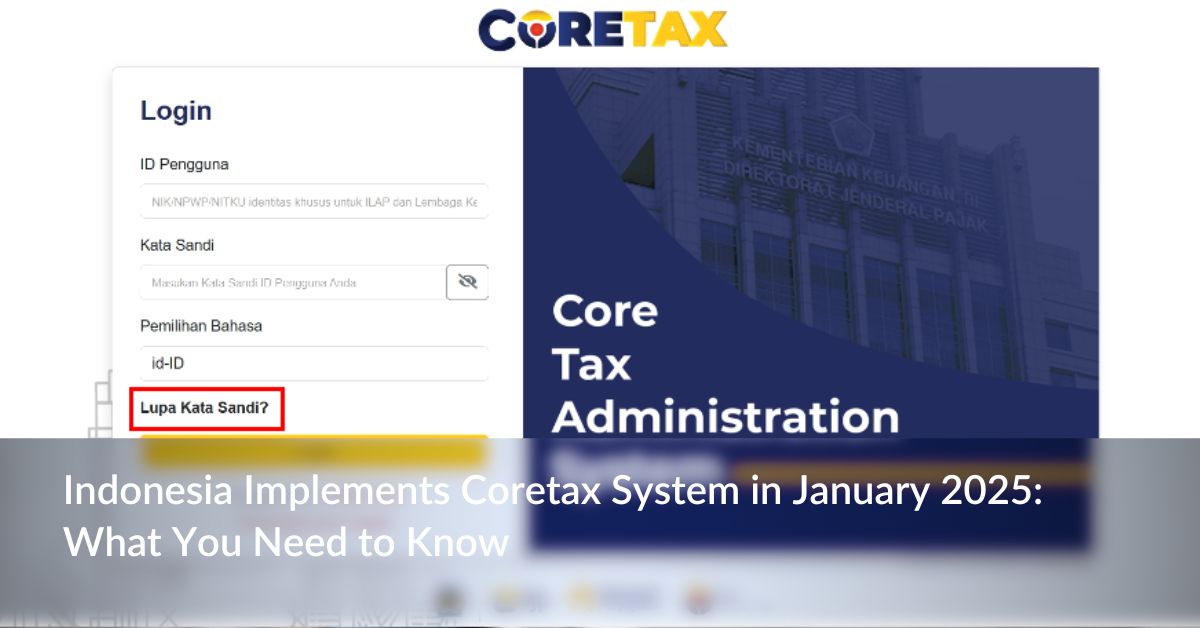

The Ministry of Finance (MoF) on October 18, 2024 introduced Regulation No. 81 (MoF-81) to streamline and develop different tax regulations. This was done in order to ensure that the new CoreTax Administration System (CoreTax) would be effective from 1 January 2025. This is a major reform effort that seeks to improve the effectiveness, reliability […]

Lets Move Indonesia

01/30/2025

17th of January, 2025 – Aligning with the regulation change in Indonesia regarding adjustments to the Penerimaan Negara Bukan Pajak (PNBP), or Non-Tax State Revenue in 2024, Lets Move Indonesia as the Indonesia announces a revised pricing structure for our comprehensive services. This adjustment isn’t simply a response to regulatory changes, it reflects a reaffirmation […]

Lets Move Indonesia

01/17/2025

Indonesia welcomed the inauguration of its membership in BRICS organisation after being announced by the 2025 Chair of BRICS, Brazil on Monday, (6/1/2025). Through the official statement, the Ministry of Foreign Affairs confirmed that the membership in BRICS represents a strategic step to strengthen democratic collaboration with other developing countries under the framework of inclusivity, […]

Lets Move Indonesia

01/12/2025

Indonesia’s tax system continues to play a pivotal role in supporting national development and achieving fiscal sustainability. However, enhancing tax revenue remains a significant challenge for the government, as annual targets consistently rise amidst various obstacles. As of 31 October 2024, Indonesia tax revenue reached IDR 1,517.5 trillion, approximately 76.3% of the State Budget (APBN) […]

Lets Move Indonesia

01/02/2025