Lets Move Indonesia

Welcome to Tax & Accountancy Services Bali

Looking for a reliable partner that professionally helps you comply with tax regulations? Then welcome to Lets Move Indonesia.

Welcome to Tax Services Bali

If you live in Bali and need assistance with tax payments and reporting, then welcome to Tax and Accountancy Bali, underwritten by the market leading legal and tax agency, LetsMoveIndonesia.

Living in Bali is a dream for many foreigners who come for various purposes. However, it is important to note that Bali is part of Indonesia, one of the least tax-friendly countries in the world. It is thus important to stay on top of the latest regulations in Indonesia, especially when it comes to paying and reporting taxes.

At LetsMoveIndonesia, we have consultants who have assisted over thousands of clients with visa, tax and legal matters. We ensure that your monthly and annual tax reporting process goes off without a hitch in accordance with the latest regulations in Indonesia. Whether you are an individual, a small business in Bali, or a corporation, make sure you stay compliant with Indonesia’s tax regulations with letsMoveIndonesia.

Why Trusting LetsMoveIndonesia with Your Tax Process

- Most referred as The Best Tax Consulting Services

- Well established with 4 professional and accessible offices

- The most cost-effective agency for your tax compliance

- The first agency with transparent price setting

- Awarded the title "Best Visa & Business Consultancy Award"

One Minute to Tax & Accountancy Services Bali

Tax for Small Business in Bali

Small businesses in Bali are eligible for Tax Incentives. Some small enterprises within certain conditions are entitled to a 50% tax discount of the standard rate. This discount is applied proportionally on gross taxable income up to IDR 4.8 billion.

Certain enterprises with gross turnover of no more than IDR 4.8 billion will still be subject to final income tax at 0.5% from the gross turnover.

Individual and Corporate Tax

Both a local company and a foreign company with a permanent establishment in Indonesia are subject to a standard corporate income tax of 22% and can file a corporate tax return yearly.

Individual tax refers to the tax payable by an individual whose payroll is eligible for a tax payment. Tax rates for individuals in Indonesia ranges between 5% and 35% of income. Meanwhile, non-residents are subject to a 20% withholding tax of income received in Indonesia.

Some of Our Most Popular Tax Services Bali Products

Annual Corporate Tax Reporting

Obtain the best assistance in reporting Corporate Tax in Indonesia professionally.

Price starts from

IDR 10.000.000

Annual Individual Tax Reporting

Report your Individual Tax in Indonesia efficiently without hassle.

Price starts from

IDR 3.000.000

Monthly Payroll Services

Maintain your office payroll compliance organised and runs smoothly every month.

Price starts from

IDR 2.500.000

Documents to Report Tax in Bali

There are several documentation that should be submitted prior to tax reporting. Those are known as follow:

- Company’s Tax ID (NPWP) and its Registration Certificate (SKT).

- Any previous tax documents and their supporting materials (if any).

- Balance Sheet

- Income Statement

- Comprehensive Financial Reports for the year

- List of prepaid payments, leases and their amortization

- General Ledger, and;

- List of Assets and associated depreciation.

Failure in Complying with Tax in Bali

If you fail to file your annual tax return on time, you will be charged a certain amount of monthly interest on the tax payable. On top of that, you will be required to pay an administrative sanction fee of IDR 100,000 for a personal income tax return, or IDR 1,000,000 for a corporate income tax return.

For individuals who stay less than 183 days in a year in Indonesia, you are not obligated to file an income tax return in the country.

Meet Our Bali Team

Frequenty Asked Questions

The forms to report tax can be requested at tax offices (KPPs). If you report your tax through LetsMoveIndonesia, all the forms collection are included.

There are mainly two types of tax reports you should file. As an individual, you should adhere with individual tax reporting which can be done monthly or annualy. If you have a business in Bali, submitting corporate tax report is compulsory.

Yes. The tax office requires all expatriates resident in Bali to register with the tax office and obtain their own separate tax number (NPWP) and pay monthly income taxes, file annual tax returns, and pay tax on their income earned outside Indonesia, less tax paid in other jurisdictions on the additional overseas income.

- Company’s Tax ID (NPWP) and its Registration Certificate (SKT).

- Any previous tax documents and their supporting materials (if any).

- Balance Sheet – Income Statement

- Comprehensive Financial Reports for the year

- List of prepaid payments, leases and their amortization

- General Ledger, and;

- List of Assets and associated depreciation.

Your tax return should be sent to the particular tax office (KPP) that you or your company registers as a taxpayer.

LetsMoveIndonesia is trusted to be the best tax consultancy across Jakarta and Bali to help your tax reporting and accounting process in Bali runs smoothly.

Incomes That Are Included as Tax Objects

The Indonesian personal taxation system is based on worldwide income. This includes:

- Any salary paid to you for your current position, whether it be onshore or offshore

- Dividend and interest income, both onshore and offshore – Rental income both onshore and offshore

- Capital gains from sale of property, both offshore and onshore

How the Tax Services Process Works

Step 1

Book a free consultation by phone, video call or in one of our offices.

Step 2

We will listen to you individual requirements and provide the best solution to your business needs.

Step 3

Collect documentation and process.

Step 4

Our Tax Consultants will then make sure your tax reporting process runs smoothly.

Step 5

Provide you with the company registration documents.

Frequently asked questions

Whether you have a business in Bali or any other cities in Indonesia, it is compulsory to submit monthly and annual tax reports even if your company does not have any business activities, hence zero taxes.

To report tax return in Bali, a tax subject should formerly register for a tax id number. Without it, it is likely impossible to report your tax. To add to the note, there are also consequences of ignoring register yourself as an authorized taxpayer

Withholding tax is one of the tax withholding or collection systems, where the government gives trust to third parties to carry out the obligation to withhold or collect taxes on income paid to income recipients.

The deadline for Tax Return reporting for individual taxpayers or employees is no later than three months after the end of the tax year or at the end of March. As for business entity taxpayers, the deadline is four months after the end of the tax year, at the end of April. If you are not sure of how to report tax for your business or personal, then contact LetsMoveIndonesia’s tax consultants through FREE consultations.

Value Added Tax (VAT) is a 11% consumption tax imposed at every stage of production of both goods and services until the sale of the final product.

Bali does not have localised regulations regarding tax and accountancy, so any late payments will then follow Indonesia’s tax policies and potentially attract interest penalties with a rate ensuing from the application of the MoF Interest Rate (MIR) plus additional charge.

LetsMoveIndonesia has 4 offices spread across Jakarta and Bali to handle hundreds of corporate and individual accounts in Indonesia every year with our efficient tax services. We have the best professional resources in the country to help with your Tax and Accountancy.

Our tax, visa, and legal consultants assist to eliminate thousands of worries in visa application, business registration, and tax reporting processes in Indonesia. We are proud to be the market leader in Indonesia Visas and Market Entry services, and helping your business to always be on top of the correct regulations, leading more and more people turn to LetsMoveIndonesia to help with their tax and accounting needs due to our ethic and transparent price settings.

Latest News

Get to Know Latest Business & Visa Updates

Bali has become a top choice for foreigners to invest in real estate. But research on the property market can be tricky if you are unaware of the local laws and regulations. The good news is that buy a property in Bali is actually a possibility for foreign investors, yet there are regulations and rules on […]

Lets Move Indonesia

03/25/2025

Indonesia property market in 2025 is presenting a golden chance to investors. Rapidly growing economy, urbanization, and favorable government policies, now it is the right time to enter into this market. Let’s discover more about it. Current Trends in the Indonesia Property Market The Indonesian economic growth train on track with an annual increase rate […]

Lets Move Indonesia

03/25/2025

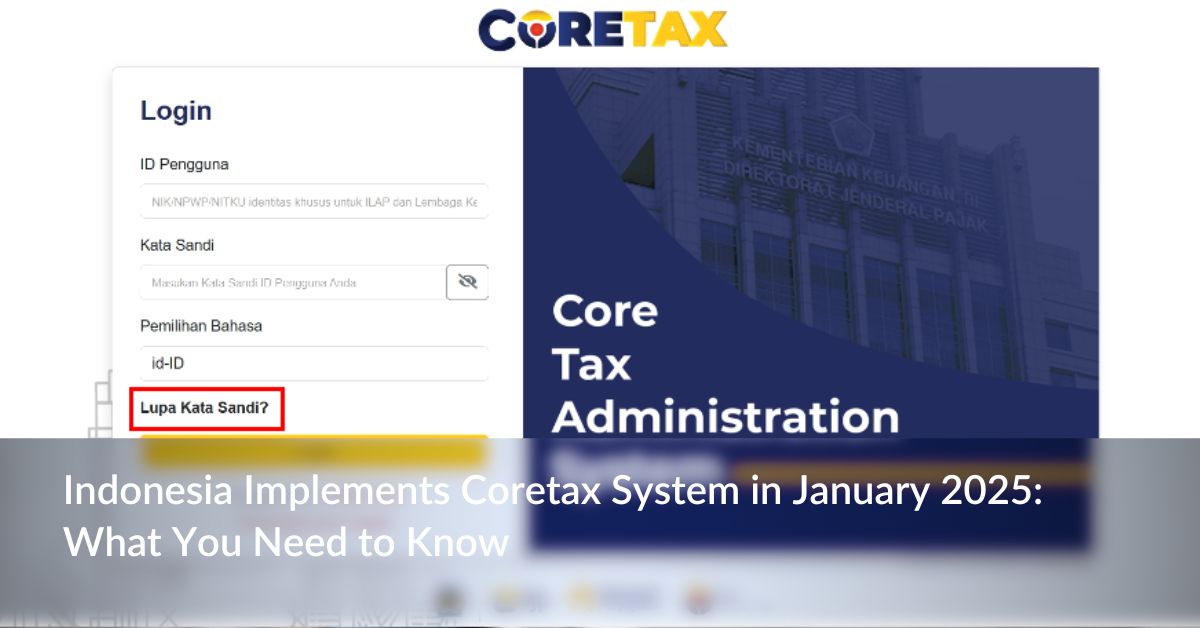

The Ministry of Finance (MoF) on October 18, 2024 introduced Regulation No. 81 (MoF-81) to streamline and develop different tax regulations. This was done in order to ensure that the new CoreTax Administration System (CoreTax) would be effective from 1 January 2025. This is a major reform effort that seeks to improve the effectiveness, reliability […]

Lets Move Indonesia

01/30/2025

17th of January, 2025 – Aligning with the regulation change in Indonesia regarding adjustments to the Penerimaan Negara Bukan Pajak (PNBP), or Non-Tax State Revenue in 2024, Lets Move Indonesia as the Indonesia announces a revised pricing structure for our comprehensive services. This adjustment isn’t simply a response to regulatory changes, it reflects a reaffirmation […]

Lets Move Indonesia

01/17/2025

Indonesia welcomed the inauguration of its membership in BRICS organisation after being announced by the 2025 Chair of BRICS, Brazil on Monday, (6/1/2025). Through the official statement, the Ministry of Foreign Affairs confirmed that the membership in BRICS represents a strategic step to strengthen democratic collaboration with other developing countries under the framework of inclusivity, […]

Lets Move Indonesia

01/12/2025

Indonesia’s tax system continues to play a pivotal role in supporting national development and achieving fiscal sustainability. However, enhancing tax revenue remains a significant challenge for the government, as annual targets consistently rise amidst various obstacles. As of 31 October 2024, Indonesia tax revenue reached IDR 1,517.5 trillion, approximately 76.3% of the State Budget (APBN) […]

Lets Move Indonesia

01/02/2025