Lets Move Indonesia

Tax & Accountancy Services

Welcome to Lets Move Indonesia’s Tax page where you can find a variety of cost effective, reliable and professional solutions to facilitate your business’s needs.

Why Use LetsMoveIndonesia?

At LetsMoveIndonesia, we ensure your business in Indonesia professionally complies with Financial Obligations in Indonesia. With years of experience in tax management, LetsMoveIndonesia becomes a trusted partner for many businesses in Indonesia.

Our tax consultants know the best of local tax policies and will help to save you the hassle by staying on top of the latest regulation changes. We strive for excellence by fully comprehending your issues and requirements, and creating unique solutions tailored to your business.

Save more time, effort, and money on your daily operations with the tailored tax services from LetsMoveIndonesia.

Gusti Suma

Tax & Legal Consultant

LetsMoveIndonesia

Indonesia’s Reliable Tax Partner

LetsMoveIndonesia is proud to offer a variety of exclusive Tax & Accountancy packages to ensure your business runs smoothly. Experience tax management at a cost-effective price.

With offices in key strategic locations in both Jakarta & Bali, LetsMoveIndonesia offers free walk-in consultations – at your convenience. Have a question? Then let our experienced team help!

The One-Stop Solution For Your Tax Compliance

- We are the most trusted tax consultancy that adopts transparent pricing with excellent service

- We help prepare and submit your annual tax report to comply with the requirements from the tax authorities

- Create your Financial Statement (Income Statement and Balance Sheet) as required by the tax authorities

- Create your Financial Statement (Income Statement and Balance Sheet) as required by the tax authorities

The LetsMoveIndonesia Tax & Accountancy Packages!

Save time, money & stress by combining our services

Non-VAT Registered Tax Package

Price only

IDR30.000.000 Per Year

Monthly Tax Reporting

Annual Tax Reporting

–

Payroll & Tax Management

Price only

IDR54.000.000 Per Year

Monthly Payroll

Monthly Tax Reporting

Annual Tax Reporting

The Works

Price only

IDR78.000.000 Per Year

Monthly Payroll & Accountancy

Monthly Tax Reporting

Annual Tax Reporting

Our Services

Prices Start From Only 2,500,000 IDR

Monthly Tax Reporting is mandatory for all businesses in Indonesia, regardless of whether you are running a profit or not. Reporting accurate data is essential, which is why our experienced team is here to provide guidance and support.

Prices Start From Only 5,000,000 IDR

If you live in Indonesia and run a business or receive any source of income, then you are required to comply with Annual Tax Reporting. Need a reliable partner? LetsMoveIndonesia is on hand to support you.

Prices Start From Only 3,500,000 IDR

Whether you are an entrepreneur, an employee or even a government worker, you must file an Individual Tax Report annually to the Indonesia Tax Authority. Need advice? Then book your free 1-hour consultation with LetsMoveIndonesia.

Prices Start From Only 5,000,000

Monthly Tax Reporting is mandatory for all businesses in Indonesia, regardless of whether you are running a profit or not. Reporting accurate data is essential, which is why our experienced team is here to provide guidance and support.

Prices Start From Only 2,000,000 IDR

If your business is VAT Registered, you are obligated to report VAT transactions every month. This may appear time consuming but is absolutely essential to avoid sizeable late payment penalties. Our team can do all the hard work for you at a very cost-effective price.

Prices Start From Only 30,000,000 IDR

Our Tax & Accountancy packages are designed to save you costs, whilst comprehensively servicing your business.

Prices Start From Only 2,500,000 IDR

Online Tax services registration. We offer to assist any company that needs their company to register EFIN.

Prices Start From Only 6,000,000 IDR

Online Tax services registration. We offer to assist any company that needs their company to register EFIN.

Prices Start From Only 2,500,000 IDR

We offer payroll management to any company that needs payroll services for their company.

Prices Start From Only 2,500,000 IDR

Indonesian Government Social Security Service registration for staff and employees to the government scheme.

Prices Start From Only 2,000,000 IDR

We offer our assistance in reporting Investment reports to the government per quarter.

Prices Start From Only 2,000,000 IDR

We offer our assistance in reporting a company’s employment status to the government annually.

The LetsMoveIndonesia Tax and Accountancy Packages!

Save time, money & stress by combining our services

VAT Registered Tax Package

Price only

IDR 40,000,000

Save IDR 7 Million Per Year

Monthly Tax Reporting

Monthly VAT Reporting

Annual Tax Reporting

Payroll & Tax Management

Price only

IDR 48,000,000

Save IDR 12 Million Per Year

Monthly Payroll

Monthly Accountancy

–

Zero Transaction Reporting

Price only

IDR 10,000,000.

Save IDR 25 Million Per Year

Monthly Tax Reporting

Annual Tax Reporting

–

Frequently asked questions

Essentially, there are four types of tax (Pajak) in Indonesia. Personal Income Tax is the type of tax for personal tax obligation, Corporate Income Tax, VAT (Value Added Tax), and Import Tax.

A company whose domicile is in Indonesia is subject to the tax obligations set by the Indonesian government. Similarly, a foreign company that has a (permanent) establishment in Indonesia – and carries out business activities through this local entity must be under Indonesian tax regulation.

.

Bookkeeping involves the documentation of any financial activity that takes place within a business or organization. This includes the generation of source documents for all transactions, operations and events that occur. It is part of the accounting process.

The ever-changing laws and regulations in Indonesia makes it hard to stay compliant with the newest policies, especially when speaking about tax reporting, which most of the times leads tax subjects to a failure in understanding the correct tax return requirements. Having an assistance of a reliable tax consultant will massively help cutting off the confusion and providing comprehensive steps to help reporting your tax return, while giving you advises regarding tax matters. A professional tax consultant will make sure your tax and accounting process runs smoothly while staying on top of Indonesia’s Tax regulations.

Of course. Our tax consultants handle hundreds of corporate accounts every year. We have the best resources to help with your Tax and Accounting matters.

Our Tax, Visa and Legal consultants help eliminating thousands of worries in Visa applications, Business registrations and Tax reporting process. We are proud to be the market-leading agency in providing Visa and Market Entry services for both national and international clients. Due to our ethics in performances and price settings, more and more people turn to LetsMoveIndonesia every year to help with their tax and accounting needs.

Latest News

Get to Know Latest Business & Visa Updates

Bali has become a top choice for foreigners to invest in real estate. But research on the property market can be tricky if you are unaware of the local laws and regulations. The good news is that buy a property in Bali is actually a possibility for foreign investors, yet there are regulations and rules on […]

Lets Move Indonesia

03/25/2025

Indonesia property market in 2025 is presenting a golden chance to investors. Rapidly growing economy, urbanization, and favorable government policies, now it is the right time to enter into this market. Let’s discover more about it. Current Trends in the Indonesia Property Market The Indonesian economic growth train on track with an annual increase rate […]

Lets Move Indonesia

03/25/2025

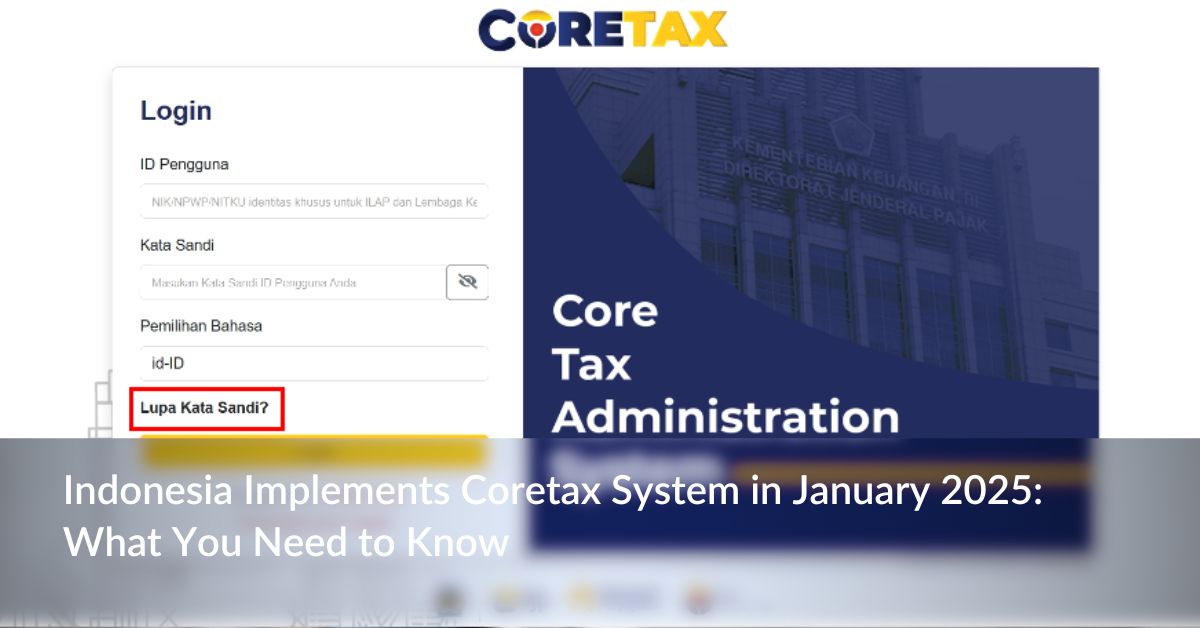

The Ministry of Finance (MoF) on October 18, 2024 introduced Regulation No. 81 (MoF-81) to streamline and develop different tax regulations. This was done in order to ensure that the new CoreTax Administration System (CoreTax) would be effective from 1 January 2025. This is a major reform effort that seeks to improve the effectiveness, reliability […]

Lets Move Indonesia

01/30/2025

17th of January, 2025 – Aligning with the regulation change in Indonesia regarding adjustments to the Penerimaan Negara Bukan Pajak (PNBP), or Non-Tax State Revenue in 2024, Lets Move Indonesia as the Indonesia announces a revised pricing structure for our comprehensive services. This adjustment isn’t simply a response to regulatory changes, it reflects a reaffirmation […]

Lets Move Indonesia

01/17/2025

Indonesia welcomed the inauguration of its membership in BRICS organisation after being announced by the 2025 Chair of BRICS, Brazil on Monday, (6/1/2025). Through the official statement, the Ministry of Foreign Affairs confirmed that the membership in BRICS represents a strategic step to strengthen democratic collaboration with other developing countries under the framework of inclusivity, […]

Lets Move Indonesia

01/12/2025

Indonesia’s tax system continues to play a pivotal role in supporting national development and achieving fiscal sustainability. However, enhancing tax revenue remains a significant challenge for the government, as annual targets consistently rise amidst various obstacles. As of 31 October 2024, Indonesia tax revenue reached IDR 1,517.5 trillion, approximately 76.3% of the State Budget (APBN) […]

Lets Move Indonesia

01/02/2025

Get Your Free Consultation Now!

Start your journey in Indonesia hassle-free with Lets Move Indonesia’s Visa and Market Entry Solutions. Chat with our consultants for more information.