- Home

- Legal Services

- PT Company Registration

PT Company Registration

Company Registration & Legal Services

- Share:

PT Registration - Who is it for and what are the benefits

PT Registration, short for Perseroan Terbatas company registration, is specifically for businesses in Indonesia that wish to establish a limited liability company.

PT Registration is suitable for Indonesian entrepreneurs who want to establish a formal legal entity to conduct their business activities. It provides a structure that separates personal assets from business liabilities, offering limited liability protection.

A PT (Perseroan Terbatas) is a local company, designed for Indonesian citizens and therefore we would only recommend setting up this type of business if you are either Indonesian or have a trustworthy Indonesian partner. If you are a foreigner we would recommend setting up a PMA. To find out more about PMA Establishment, you may check our PT PMA Establishment Page here!

Additionally, there are some business entities that are only available to Indonesian Companies, therefore, even if you are a foreign company or individual, you may still need to set up a PT.

At LetsMoveIndonesia, we specialise in assisting businesses with PT company registration and provide comprehensive support throughout the process, helping you establish a strong legal foundation for your business in Indonesia.

LetsMoveIndonesia’s expert teams are located across Jakarta & Bali, ready to assist you completely with a hassle-free company registration process!

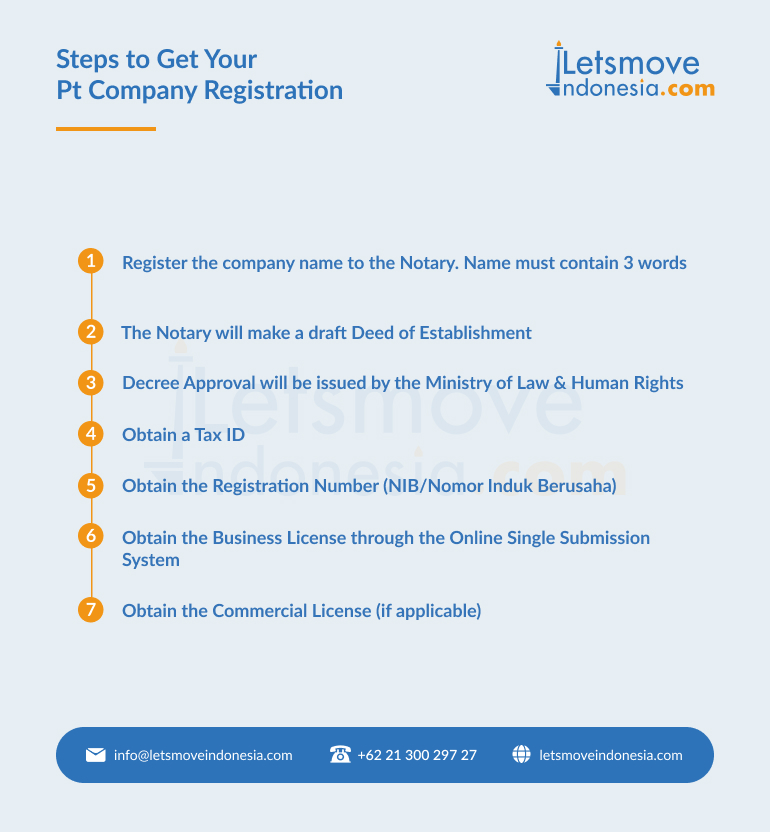

Steps to Register A Company in Indonesia

- Register the company name to the Notary. The name must contain 3 words

- The Notary will make a draft Deed of Establishment

- Decree Approval will be issued by the Ministry of Law & Human Rights

- Obtain a Tax ID

- Obtain the Registration Number (NIB/Nomor Induk Berusaha)

- Obtain the Business License through the Online Single Submission System

- Obtain the Commercial License (if applicable)

- Limited Liability Protection: One of the primary benefits of PT registration is limited liability protection. The shareholders’ liability is generally limited to the value of their subscribed shares, minimizing personal financial risk in the event of business debts or legal issues.

Benefits of Setting Up a PT Company in Indonesia

Separate Legal Entity: A PT is considered a separate legal entity from its shareholders. This distinction provides the company with the ability to enter into contracts, acquire assets, and engage in legal proceedings on its own behalf, separate from its owners.

Investor Attraction: PT registration can enhance your business’s credibility and attract potential investors. Many investors prefer to invest in formal legal entities that offer limited liability protection and clear corporate governance structures.

Access to Local Market: Registering as a PT enables you to access the vast Indonesian market. It demonstrates your commitment to complying with local regulations and building trust among local customers, suppliers, and partners.

Perpetual Existence: A PT has perpetual existence, meaning it continues to exist regardless of changes in its ownership structure or the death of shareholders. This ensures continuity and stability for long-term business operations and future succession planning.

Ability to Hire Employees: As a registered PT, you can legally hire employees in Indonesia, allowing you to expand your workforce and scale your business operations as needed.

Financing Opportunities: PT registration opens doors to various financing opportunities, such as accessing bank loans, attracting investment, and issuing shares or bonds to raise capital for business growth and expansion.

Professional Image: Registering as a PT enhances your professional image and instils confidence in potential clients and business partners. It demonstrates that you are committed to operating according to Indonesia’s formal and legally compliant manner.

Minimum Requirements to Register a PT in Indonesia

- 2 Local Shareholders

- 1 Local Director

- 1 Local Commissioner

Additionally, there are 3 different-sized companies you can establish in Indonesia, and each of them requires a different amount of investment/paid-in capital.

- Small: Above IDR 50.000.000 – 500.000.000

- Medium: Above IDR 500.000.000 – 10.000.000.000

- Large: Above IDR 10.000.000.000

Please note that if you want to employ foreigners in a PT, the company size must be at least Medium-sized with a paid-in capital above IDR 1.100.000.000.

Please note, that if you want to employ foreigners, in a PT, the company size must be at least Medium with a paid in capital above IDR 1.100.000.000.

Document Requirements to Setup a PT Company in Indonesia

1. Minimum 2 shareholders

2. Identity and contact details of Company Shareholders:

– For Indonesian Individuals, KTP and NPWP

– For Indonesian Companies, copy of Article of Establishment and the amendments and the Approval from the Ministry of Law and Human Right, Domicile Letter, Tax Id, Business License, Company Registration Certificate (TDP/NIB)

3. Identity and contact details of Company Directors and Commissioner:

– For Indonesian individuals, KTP, NPWP, email and phone number.

– For Foreign Individuals, valid passport, email and phone number.

4. Original Domicile from building management

5. Copy of Lease Agreement between company and building management

Be at Ease With Company Registration Indonesia Package at LetsMoveIndonesia

To make your life simpler, LetsMoveIndonesia offers fully serviced packages to get your business off the ground. The High Flyer Package includes PT Establishment, a virtual office and an express KITAS! To find out more details about The High Flyer Package, click here!

Want to know more about setting up a business in Indonesia? Then check out our useful guides!

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

More of Our Popular Indonesia Legal Services

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

Bali has become a top choice for foreigners to invest in real estate. But research on the property market can be tricky if you are unaware of the local laws and regulations. The good news is that buy a property in Bali is actually a possibility for foreign investors, yet there are regulations and rules on […]

Lets Move Indonesia

03/25/2025

Indonesia property market in 2025 is presenting a golden chance to investors. Rapidly growing economy, urbanization, and favorable government policies, now it is the right time to enter into this market. Let’s discover more about it. Current Trends in the Indonesia Property Market The Indonesian economic growth train on track with an annual increase rate […]

Lets Move Indonesia

03/25/2025

The Ministry of Finance (MoF) on October 18, 2024 introduced Regulation No. 81 (MoF-81) to streamline and develop different tax regulations. This was done in order to ensure that the new CoreTax Administration System (CoreTax) would be effective from 1 January 2025. This is a major reform effort that seeks to improve the effectiveness, reliability […]

Lets Move Indonesia

01/30/2025

17th of January, 2025 – Aligning with the regulation change in Indonesia regarding adjustments to the Penerimaan Negara Bukan Pajak (PNBP), or Non-Tax State Revenue in 2024, Lets Move Indonesia as the Indonesia announces a revised pricing structure for our comprehensive services. This adjustment isn’t simply a response to regulatory changes, it reflects a reaffirmation […]

Lets Move Indonesia

01/17/2025

Indonesia welcomed the inauguration of its membership in BRICS organisation after being announced by the 2025 Chair of BRICS, Brazil on Monday, (6/1/2025). Through the official statement, the Ministry of Foreign Affairs confirmed that the membership in BRICS represents a strategic step to strengthen democratic collaboration with other developing countries under the framework of inclusivity, […]

Lets Move Indonesia

01/12/2025

Indonesia’s tax system continues to play a pivotal role in supporting national development and achieving fiscal sustainability. However, enhancing tax revenue remains a significant challenge for the government, as annual targets consistently rise amidst various obstacles. As of 31 October 2024, Indonesia tax revenue reached IDR 1,517.5 trillion, approximately 76.3% of the State Budget (APBN) […]

Lets Move Indonesia

01/02/2025