- Home

- Legal Services

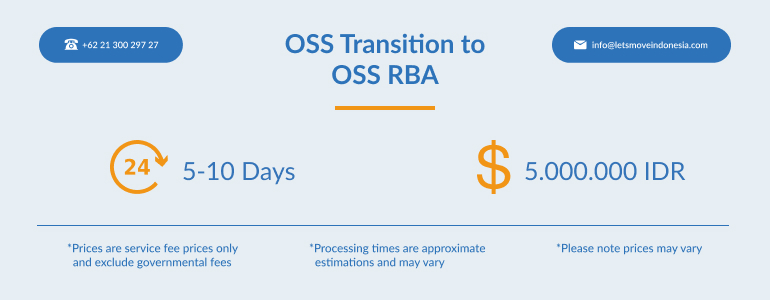

- OSS Transition to OSS RBA

OSS Transition to OSS RBA

Company Registration & Legal Services

- Share:

OSS Transition to OSS RBA – Who is it for and what are the benefits

Online Single Submission Risk Based Approach (OSS-RBA) or Risk Based Business Licensing is a business licence granted to business actors to start and run their business activities which are assessed based on the level of risk.

OSS RBA licences are only required by businesses with high-risk business activities. Meanwhile, businesses with low to no risk will generally not require licences or inspections from the government.

With this risk-based system, it will be easier for high-risk businesses to apply for business licences so that business licences that require verification will be minimised.

Common Questions

What are the legal sources for OSS-RBA?

Peraturan Pemerintah No.5 Tahun 2021

Is the previous OSS license that has been issued still valid after I re-register to OSS-RBA?

Depend on the licenses, but if we process the Transition, it is already included that we update your Existing licenses.

What is categorised as high-risk businesses?

The system will analyze your Company and based on the Capital, Location Zone, Business Classification and any other factor will determine the category.

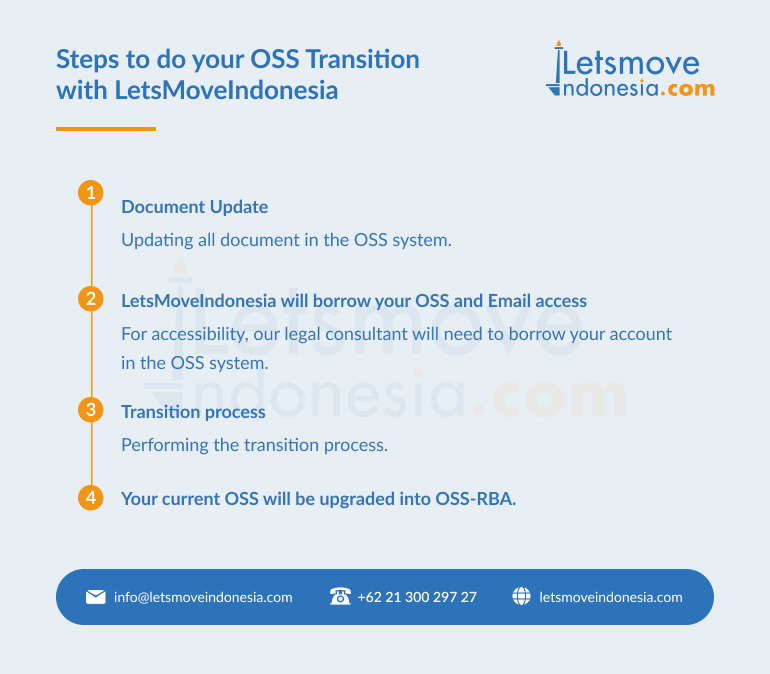

Steps to do your OSS Transition with LetsMoveIndonesia

Updating all documents in the OSS system.

For accessibility, our legal consultant will need to borrow your account in the OSS system

Performing the transition process.

Requirements

- Identity of Board of Director, Commissioner, and Shareholders (KTP/Passport)

- Deed of company establishment and its amendments (if any) / Akta Pendirian Perusahaan D& Perubahannya (bila ada)

- Decree Approval from Ministry of Law and Human Rights / SK Kemenkumham

- Tax ID of company / NPWP Perusahaan

- Email and Phone Number of the Company

- Username and Password OSS (if any)

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

More of Our Popular Indonesia Legal Services

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

Bali has become a top choice for foreigners to invest in real estate. But research on the property market can be tricky if you are unaware of the local laws and regulations. The good news is that buy a property in Bali is actually a possibility for foreign investors, yet there are regulations and rules on […]

Lets Move Indonesia

03/25/2025

Indonesia property market in 2025 is presenting a golden chance to investors. Rapidly growing economy, urbanization, and favorable government policies, now it is the right time to enter into this market. Let’s discover more about it. Current Trends in the Indonesia Property Market The Indonesian economic growth train on track with an annual increase rate […]

Lets Move Indonesia

03/25/2025

The Ministry of Finance (MoF) on October 18, 2024 introduced Regulation No. 81 (MoF-81) to streamline and develop different tax regulations. This was done in order to ensure that the new CoreTax Administration System (CoreTax) would be effective from 1 January 2025. This is a major reform effort that seeks to improve the effectiveness, reliability […]

Lets Move Indonesia

01/30/2025

17th of January, 2025 – Aligning with the regulation change in Indonesia regarding adjustments to the Penerimaan Negara Bukan Pajak (PNBP), or Non-Tax State Revenue in 2024, Lets Move Indonesia as the Indonesia announces a revised pricing structure for our comprehensive services. This adjustment isn’t simply a response to regulatory changes, it reflects a reaffirmation […]

Lets Move Indonesia

01/17/2025

Indonesia welcomed the inauguration of its membership in BRICS organisation after being announced by the 2025 Chair of BRICS, Brazil on Monday, (6/1/2025). Through the official statement, the Ministry of Foreign Affairs confirmed that the membership in BRICS represents a strategic step to strengthen democratic collaboration with other developing countries under the framework of inclusivity, […]

Lets Move Indonesia

01/12/2025

Indonesia’s tax system continues to play a pivotal role in supporting national development and achieving fiscal sustainability. However, enhancing tax revenue remains a significant challenge for the government, as annual targets consistently rise amidst various obstacles. As of 31 October 2024, Indonesia tax revenue reached IDR 1,517.5 trillion, approximately 76.3% of the State Budget (APBN) […]

Lets Move Indonesia

01/02/2025