- Home

- Legal Services

- LKPM Registration

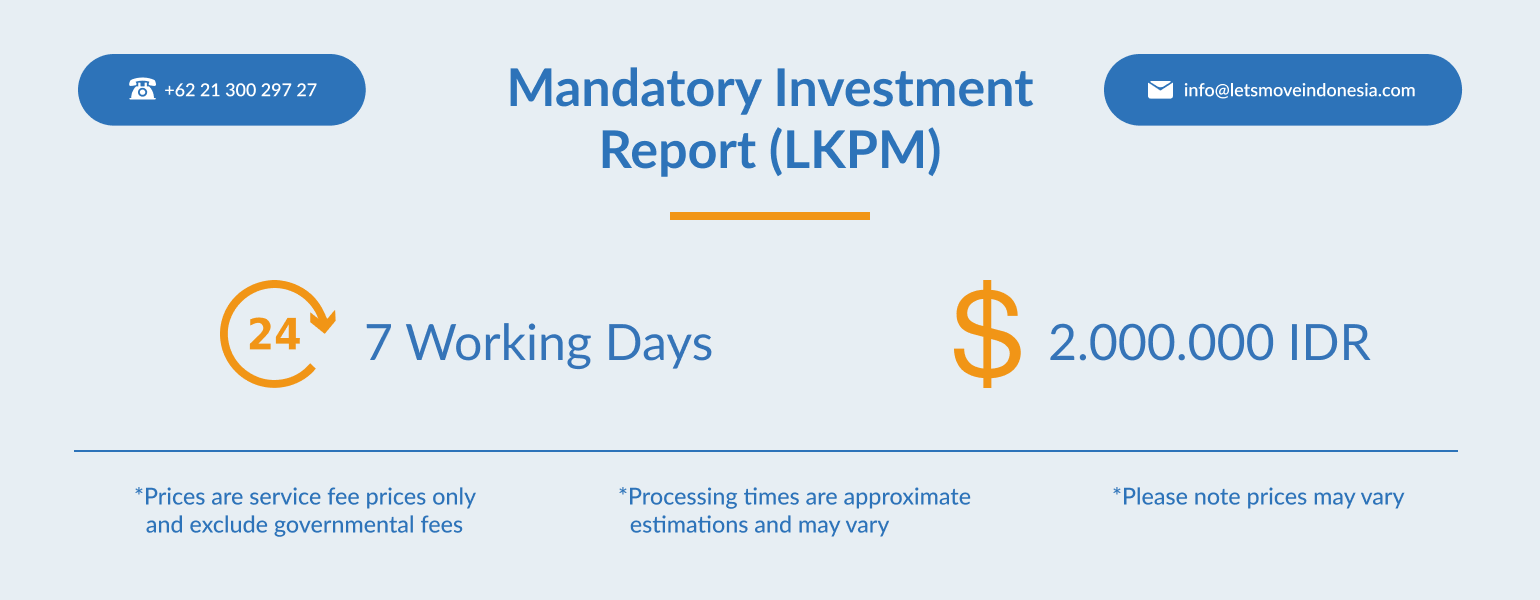

Mandatory Investment Report in Indonesia (LKPM)

Company Registration & Legal Services

- Share:

LKPM Registration in Indonesia – Who is it for and what are the benefits

Investment Activity Report (LKPM) is an obligation for every business actor as stipulated in Article 15 letter (c) of Indonesian Law No. 25 of 2007 concerning Capital Investment Article 5 letter (c) and BKPM Regulation No. 5 of 2021 concerning Guidelines and Procedures for Risk-Based Business Licensing Supervision.

LKPM is a report on the progress of Investment realization and problems faced by Business Actors that must be made and submitted periodically (Article 1 point (20) of BKPM Regulation No. 5 of 2021) which are required to submit LKPM online are all Business Actors, except Micro Business Actors, Companies in the upstream oil and gas business sector, banking, non-bank financial institutions and insurance.

Submission of the Investment Activity Report (LKPM) is a requirement for companies investing more than IDR 500,000,000 (approx. USD 33,900). This includes all companies with foreign shareholders as the minimum capital requirement for such is IDR 2,500,000,000. The company must also have an Identification Number to Operate or Nomor Induk Berusaha (NIB).

However, this does not apply to the following:

- Finance companies

- Insurance companies

- Banking companies

- Companies in the oil and gas industry

- Companies with expired operating licenses

New companies also have to submit an investment activity report. Once the Online Single Submission (OSS) System issues the NIB to your company, you will have to start submitting the LKPM.

Common Questions

When should I do LKPM report?

LKPM reports should do periodically, There are 4 quarters for each report.

Quarter 1st : Investment Report from January – March, will be reported in April;

Quarter 2nd : Investment Report from April – June, will be reported in July;

Quarter 3rd : Investment Report July – September, will be reported in October ; and

Quarter 4th : Investment Report October – December, will be reported in January.

What are the most common key points included in the LKPM report?

The most common key points included in the LKPM report are investment, labor, production, partnership as well as other obligations realization and problems faced by business actors

What will happen if I don’t report LKPM for my company?

If a business actor does not report LKPM for their company, they will get administrative sanctions based on Article 47 paragraph (1) BKPM Regulation 5/2021) :

- Written or online warning

- Restriction of Business activities

- Suspension of business activities and or investment facilities

- Revocation of business activities and or investment licenses and or investment facilities

Why should we ask a consultant's help to report LKPM?

You need consultant service to doing this to avoid errors/ mistake in submitting the reports

What kind of business does not have to report LKPM?

If your company has an investment value less than Rp. 1.000.000.000 ( one billion rupiah ) or your company is in non bank financial institutions, insurance, banking a s well as upstream oil and gas sector also if your company has a Principle Permit ( IP- Izin Prinsip), Investment Registration ( PI – Pendaftaran Penanaman Modal) and/or an inactive or expired Business License ( IU- Izin Usaha ) thats means you don’t have obligation to make a LKPM report.

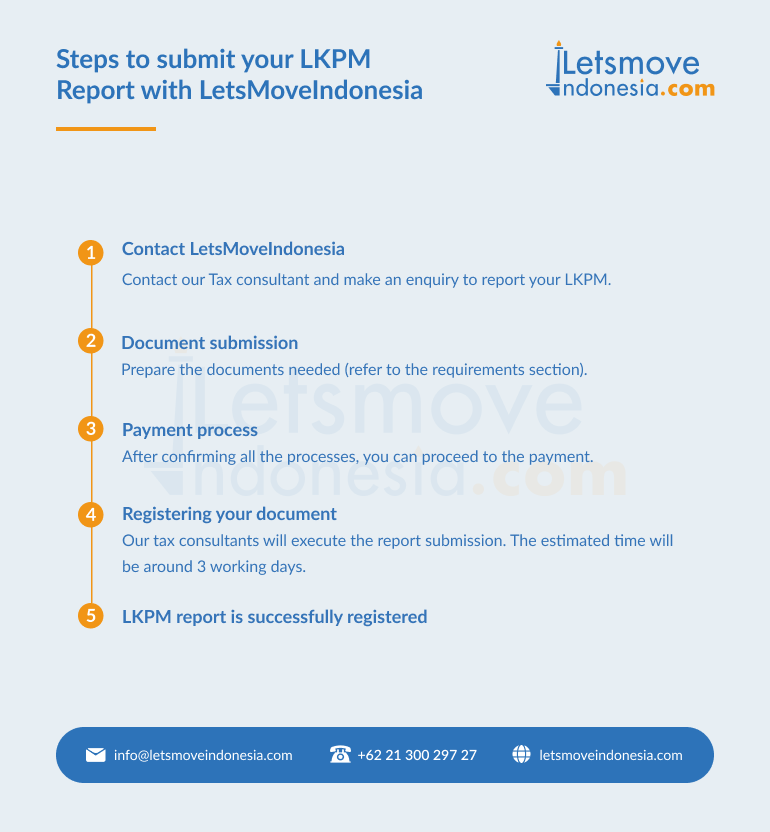

Steps to Report your LKPM with Lets Move Indonesia

- Contact our Tax consultant and make an enquiry audit to report your LKPM

- Prepare the documents needed (refer to the requirements section)

- After confirming all the processes, you can proceed to the payment

- Our tax consultants will execute the report submission. The estimated time will be around 3 working days.

Requirements

You company must prepare all the documents below :

1. Identity and contact details of Company Directors:

2. Copy of Deed of Establishment along with Decree Approval from Ministry (SK)

- For Indonesian individuals, KTP, NPWP, email and phone number.

- For Foreign Individuals, valid passport, email and phone number.

3. Copy of Amendment of Article of Association along with Decree Approval from Ministry (if any)

4. Copy of Tax ID

5. Copy of Business License

6. Copy of Registration Number (NIB)

7. Financial Report for 3 Months

8. OSS Account Access

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

More of Our Popular Indonesia Legal Services

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

For every company operating in Indonesia, understanding and properly filing annual and periodic tax returns is a core compliance obligation. Corporate tax reporting is strictly regulated by the Directorate General of Taxes (DGT), and failure to comply can lead to penalties, audits, or disruptions to business operations. This guide breaks down what corporate tax returns […]

Lets Move Indonesia

12/09/2025

Two legal permit frameworks that often cause confusion among digital entrepreneurs: PSE (Penyelenggara Sistem Elektronik) registration and the e-commerce business license, or SIUPMSE. This guide breaks down the difference between PSE and e-commerce licensing, who needs them, and why they matter. What Is a PSE License PSE stands for Penyelenggara Sistem Elektronik. It is the […]

Lets Move Indonesia

12/08/2025

If you are planning to open a business in Indonesia in 2026, it is essential to understand the latest regulatory changes issued under Peraturan Resmi BKPM No. 5 Tahun 2025. Effective 2 October 2025, this regulation reshapes how PT PMA (foreign-owned companies) are established, monitored, and managed through the OSS-RBA (Online Single Submission – Risk […]

Lets Move Indonesia

12/04/2025

Millions of Indonesians and their descendants now live overseas, forming a global community that has long sought a clear and dignified pathway to reconnect with Indonesia. For decades, returning diaspora faced complicated visa renewals, sponsorship requirements, and limited long-term options. Many families, especially those of mixed-nationality backgrounds, were left without a residency framework that recognised […]

Lets Move Indonesia

11/28/2025

From manufacturing and logistics to digital platforms and professional services, the country’s expanding economy offers immense potential for both local entrepreneurs and global investors. Thousands of business owners each year face challenges in navigating company registration, licensing requirements, and compliance obligations. The reality is that many agencies offering “company setup services” lack transparency, provide unclear […]

Lets Move Indonesia

11/28/2025

Indonesia continues to evolve into one of Southeast Asia’s most dynamic economic landscapes, with rapid digitalisation, growing industries, and an increasingly sophisticated regulatory environment. But as the system becomes more advanced, Indonesia’s tax landscape also becomes more complex. Constant updates, new reporting systems, and shifting regulations mean thousands of individuals and businesses struggle to stay […]

Lets Move Indonesia

11/28/2025