- Home

- Legal Services

- Individual NPWP Registration

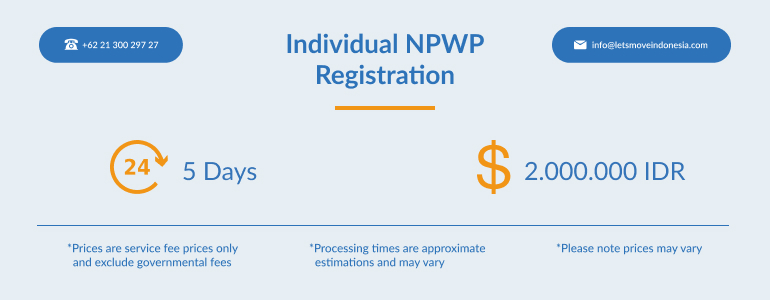

Individual NPWP Registration

Company Registration & Legal Services

- Share:

Individual NPWP Registration – Who is it for and what are the benefits

The Personal NPWP Card is as essential as the Identity Card (KTP). NPWP must be owned by people who have fulfilled certain requirements.

Taxpayer Identification Number or NPWP is a number given to taxpayers that will be used as a personal identification or identity of taxpayers in carrying out their rights and obligations in tax affairs. NPWP must be owned by Indonesian citizens, both individuals and business entities.

The Personal NPWP Card can be said to be as important as the Identity Card (KTP). NPWP must be owned by people who have fulfilled certain requirements, including expatriates who live in Indonesia.

If you are an expat and planning to live or work in Indonesia, it is mandatory for you to register for an NPWP. Registering your NPWP through LetsMoveIndonesia will save you time and hassle. We will help provide guidance through the document preparation and submitting your them so you would not have to go the extra mile to make sure the process runs smoothly.

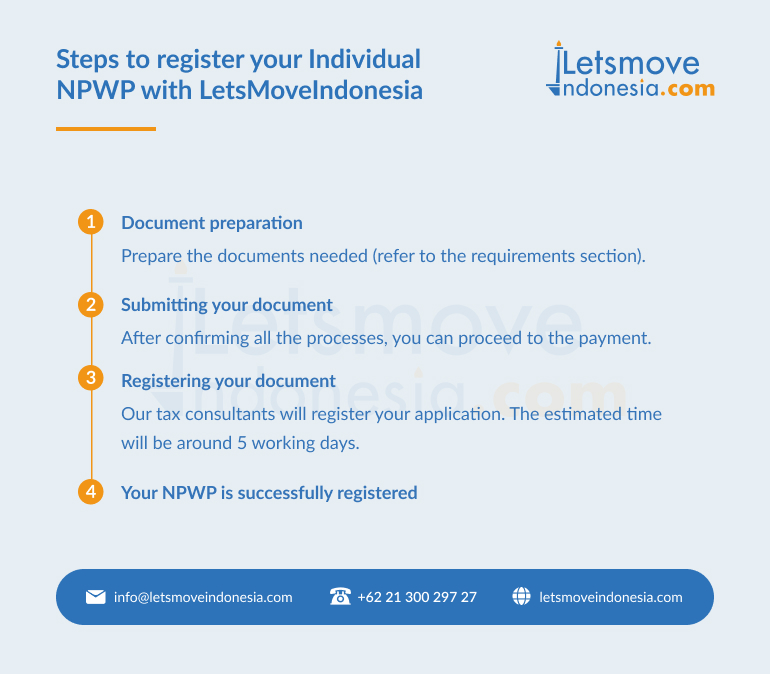

Steps to register your individual NPWP with LetsMoveIndonesia

Prepare the documents needed (refer to the requirements section).

After confirming all the processes, you can proceed to the payment.

Our tax consultants will register your application. The estimated time will be around 5 working days.

Common questions

What if I do not have an NPWP ID?

Failure to pay taxes will result in criminal penalties and fines according to pph21.

How much should I pay for my individual tax?

There are some progressive tax obligations that regulate the amount of tax according to your income. You can contact our tax consultant for more information regarding your tax compliance.

Should I obtain NPWP if I am staying with a Single Entry/Business Entry Visa?

Expatriates and non-citizens of Indonesia are obligated to pay tax only if they have been staying in Indonesia for more than 183 days. This commonly applies to KITAS and KITAP holders who plan to stay permanently, work, or conduct a commercial business in Indonesia.

Requirements

To register your NPWP ID and obtain your Identification number, there are several documents you need to prepare:

- For Indonesian Individuals, scan a copy of the KTP

- For Foreign Individuals, scan a copy of a valid passport, scan a copy of KITAS (staying permit),

- Domicile Letter from Management Building or RT/RW (Subdistrict)

- Information of email and phone number

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

More of Our Popular Indonesia Legal Services

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

Bali has become a top choice for foreigners to invest in real estate. But research on the property market can be tricky if you are unaware of the local laws and regulations. The good news is that buy a property in Bali is actually a possibility for foreign investors, yet there are regulations and rules on […]

Lets Move Indonesia

03/25/2025

Indonesia property market in 2025 is presenting a golden chance to investors. Rapidly growing economy, urbanization, and favorable government policies, now it is the right time to enter into this market. Let’s discover more about it. Current Trends in the Indonesia Property Market The Indonesian economic growth train on track with an annual increase rate […]

Lets Move Indonesia

03/25/2025

The Ministry of Finance (MoF) on October 18, 2024 introduced Regulation No. 81 (MoF-81) to streamline and develop different tax regulations. This was done in order to ensure that the new CoreTax Administration System (CoreTax) would be effective from 1 January 2025. This is a major reform effort that seeks to improve the effectiveness, reliability […]

Lets Move Indonesia

01/30/2025

17th of January, 2025 – Aligning with the regulation change in Indonesia regarding adjustments to the Penerimaan Negara Bukan Pajak (PNBP), or Non-Tax State Revenue in 2024, Lets Move Indonesia as the Indonesia announces a revised pricing structure for our comprehensive services. This adjustment isn’t simply a response to regulatory changes, it reflects a reaffirmation […]

Lets Move Indonesia

01/17/2025

Indonesia welcomed the inauguration of its membership in BRICS organisation after being announced by the 2025 Chair of BRICS, Brazil on Monday, (6/1/2025). Through the official statement, the Ministry of Foreign Affairs confirmed that the membership in BRICS represents a strategic step to strengthen democratic collaboration with other developing countries under the framework of inclusivity, […]

Lets Move Indonesia

01/12/2025

Indonesia’s tax system continues to play a pivotal role in supporting national development and achieving fiscal sustainability. However, enhancing tax revenue remains a significant challenge for the government, as annual targets consistently rise amidst various obstacles. As of 31 October 2024, Indonesia tax revenue reached IDR 1,517.5 trillion, approximately 76.3% of the State Budget (APBN) […]

Lets Move Indonesia

01/02/2025