- Home

- Tax Services

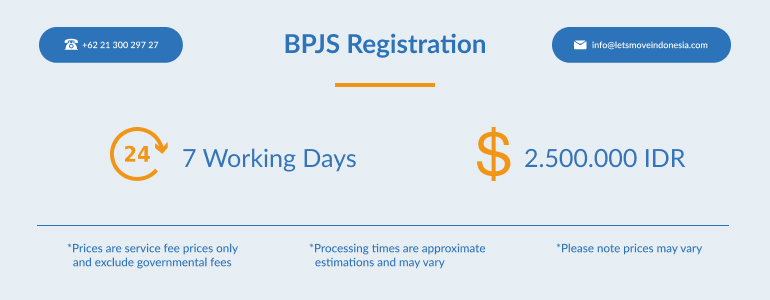

- BPJS Registration

BPJS Registration in Indonesia

Tax & Accountancy Services

- Share:

BPJS and its relevance for expatriates, has been a hotly debated topic over the years, particularly as most expatriates fail to see the personal benefit of the scheme. However, it is now a mandatory requirement for all Indonesian residents who have been living in the country for 6 months or more. Ultimately, if you are the holder or a KITAS, you will no longer be able to extend it, unless you have been keeping on top of your BPJS payments and we are here to help you with your BPJS Registration!

So, what is it and who is it for?

BPJS is a government initiative, imposed on all citizens of Indonesia to provide universal social security and consists of healthcare, pension schemes, work placed injury recompense, as well as death benefits. This whole worker social security package aims to maintain decent basic living standards when participants encounter income loss or decrease resulting from workplace injuries, old age, retirement or death.

There are 2 types of BPJS Health, BPJS Kesehatan (Health Security) as well as BPJS Ketenagjerjaan (Social Security). If you are an individual, you must register for the healthcare scheme, however, if you are a company you will need to register for social security scheme for employees.

Health Security BPJS (Kesehatan)

This is mandatory for individuals living in Indonesia and it gives the holder healthcare protection. You can determine which type of protection you would prefer and they offer 3 different classes of service, each coming at a slightly higher cost point, but with increased benefits to the users.

Social Security BPJS (BPJS Ketenagakerjaan)

If you are a business owner you must register all staff. If you are employees in Indonesia by a company they will register you and provide you with a Social Security Card. If you are working as a freelancer and would like to arrange cover, you can register for an Independent Social Security BPJS member.

Basic protection includes:

Old Age Protection, Working Accident Protection, Death Payment as well as Pension Protection.

The monthly payments for the Social Security Programme should be paid by both the employer and the employee. Amount paid is in relation to what type of protection you prefer as well as the salary itself. If you an independent member, you must pay the monthly fee by yourself.

Please note that this is not a complete insurance product, so if you require specific healthcare insurances, we would advise using an independent company.

If you need to know more or would like to register yourself or your company for BPJS, then contact the Lets Move Indonesia team! T: 021 300 297 27 E: [email protected] Visit us in our office Bellagio Mall, Jl. Mega Kuningan Barat Kav.E4 No.3, Setiabudi, Jakarta 12930, Indonesia or fill in the contact form below!

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

Indonesia enters 2026 with renewed confidence and structural momentum. Macroeconomic stability, strong liquidity support, and continued reform efforts have positioned the country as one of Southeast Asia’s most compelling long-term investment destinations. At the same time, the regulatory and compliance environment for foreign investors has become more sophisticated, requiring careful planning across company incorporation, immigration, […]

Natalia Harfiana

01/02/2026

As a subsidiary of LMI Group, Lets Move Indonesia is proud to celebrate the new year by helping thousands of foreigners live, work, and thrive in Indonesia. 2026 marks another year of our journey, and we want to honour our clients by giving them a very special offer. For more than a decade, we’ve had […]

Lets Move Indonesia

12/30/2025

Indonesia’s tourism sector has surged dramatically in recent years, reshaping the country’s immigration landscape and intensifying the spotlight on lawful stay and compliance. According to Statistics Indonesia (BPS), the country recorded approximately 13.9 million international visitor arrivals in 2024, up roughly 19% year-on-year and the highest total since the pre-pandemic era. For Australians in particular, […]

Lets Move Indonesia

12/22/2025

Overseas Indonesians, commonly referred to as the Indonesian diaspora, are individuals of Indonesian origin living abroad. In many cases, members of this group have lost their Indonesian citizenship as a result of naturalization in another country, which means they are legally considered foreign nationals and are required to obtain the appropriate visa or stay permit […]

Lets Move Indonesia

12/16/2025

For every company operating in Indonesia, understanding and properly filing annual and periodic tax returns is a core compliance obligation. Corporate tax reporting is strictly regulated by the Directorate General of Taxes (DGT), and failure to comply can lead to penalties, audits, or disruptions to business operations. This guide breaks down what corporate tax returns […]

Lets Move Indonesia

12/09/2025

Two legal permit frameworks that often cause confusion among digital entrepreneurs: PSE (Penyelenggara Sistem Elektronik) registration and the e-commerce business license, or SIUPMSE. This guide breaks down the difference between PSE and e-commerce licensing, who needs them, and why they matter. What Is a PSE License PSE stands for Penyelenggara Sistem Elektronik. It is the […]

Lets Move Indonesia

12/08/2025