- Home

- Tax Services

- Annual Tax Reporting

Annual Tax Reporting

Tax & Accountancy Services

- Share:

Annual Tax, specifically in Indonesia, is tax that needs to be paid every year to the tax authority in Indonesia, which is the Directorate General of Tax.

The subjects that are inclined to file the tax report to the tax authority in Indonesia are both individuals as well as corporates that must acquire Tax ID (NPWP) or receive income through profits such as wages, dividends, revenues, and other source of income.

In order to process the Annual Tax Report to the tax authority in Indonesia, first you need to register yourself as an individual, or the company that is subjected to comply with the Annual Tax to the Directorate General of Tax.

The registration will require a series of documents to be submitted, bearing in mind the frequent and sudden changes to tax regulations in Indonesia.

Please note that it is compulsory for the individuals and corporates to file the tax report to the Indonesian Tax Authority, which is required by the applicable Indonesian Law.

Common Questions

When is the deadline to process the Annual Tax to the Indonesia Tax Authority?

The deadline for the Individual Annual Tax would be on the 31st March every year. For the Corporate Annual Tax, it will be on 30th April every year.

Can you submit your tax report past the deadline?

- Yes, you can apply for an extension of deadline for the tax report by notifying the Directorate General of Tax beforehand.

- What happens when you’re late on submitting your report past the deadline and are there any exceptions to not file an Annual Tax Report?

- You will be charged 2% monthly interest on the payable tax, and also charged with an administrative fee of Rp.100.000 for individual tax, and Rp.1.000.000 for corporate tax.

- An individual that will only be staying for less than 183 days in Indonesia, within the taxable year, is not obligated to file the Annual Tax Report.

What if you’re leaving Indonesia? What would happen to the obligation of reporting the Annual Tax?

If you’re only leaving Indonesia temporarily, you are still obligated to file the Annual Tax Report. However, if you’re leaving Indonesia permanently, you need to notify the Indonesian Tax Authority regarding your departure and your cancellation of your Tax ID (NPWP).

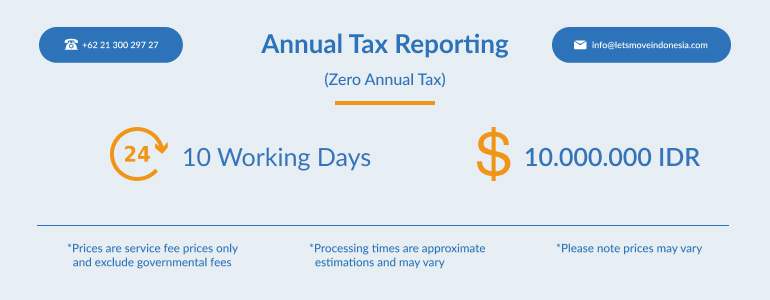

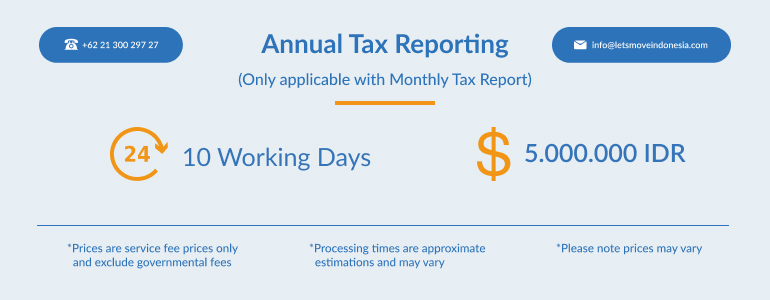

Fully inclusive Tax Packages

LetsMoveIndonesia is proud to offer a variety of exclusive Tax & Accountancy packages to ensure your business operates smoothly at a cost-effective price. To find out more about our packages, Click Here!

Want to know more about taxes in Indonesia? Then check out our useful guide!

Tax in Indonesia – Your Most Common Questions Answered!

If you need to know more or would like us to help with your tax reporting, then contact the LetsMoveIndonesia team.

Our experienced team has years of tax experience and can help with your monthly & yearly tax reporting, individual tax reporting, as well as your payroll and accountancy needs.

Make your life easier and let Jakarta’s Most Trusted Agency assist you.

T: 021 300 297 27 E: [email protected] Visit us in our office Bellagio Mall, Jl. Mega Kuningan Barat Kav.E4 No.3, Setiabudi, Jakarta 12930, Indonesia or fill in the contact form below!

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

Bali has become a top choice for foreigners to invest in real estate. But research on the property market can be tricky if you are unaware of the local laws and regulations. The good news is that buy a property in Bali is actually a possibility for foreign investors, yet there are regulations and rules on […]

Lets Move Indonesia

03/25/2025

Indonesia property market in 2025 is presenting a golden chance to investors. Rapidly growing economy, urbanization, and favorable government policies, now it is the right time to enter into this market. Let’s discover more about it. Current Trends in the Indonesia Property Market The Indonesian economic growth train on track with an annual increase rate […]

Lets Move Indonesia

03/25/2025

The Ministry of Finance (MoF) on October 18, 2024 introduced Regulation No. 81 (MoF-81) to streamline and develop different tax regulations. This was done in order to ensure that the new CoreTax Administration System (CoreTax) would be effective from 1 January 2025. This is a major reform effort that seeks to improve the effectiveness, reliability […]

Lets Move Indonesia

01/30/2025

17th of January, 2025 – Aligning with the regulation change in Indonesia regarding adjustments to the Penerimaan Negara Bukan Pajak (PNBP), or Non-Tax State Revenue in 2024, Lets Move Indonesia as the Indonesia announces a revised pricing structure for our comprehensive services. This adjustment isn’t simply a response to regulatory changes, it reflects a reaffirmation […]

Lets Move Indonesia

01/17/2025

Indonesia welcomed the inauguration of its membership in BRICS organisation after being announced by the 2025 Chair of BRICS, Brazil on Monday, (6/1/2025). Through the official statement, the Ministry of Foreign Affairs confirmed that the membership in BRICS represents a strategic step to strengthen democratic collaboration with other developing countries under the framework of inclusivity, […]

Lets Move Indonesia

01/12/2025

Indonesia’s tax system continues to play a pivotal role in supporting national development and achieving fiscal sustainability. However, enhancing tax revenue remains a significant challenge for the government, as annual targets consistently rise amidst various obstacles. As of 31 October 2024, Indonesia tax revenue reached IDR 1,517.5 trillion, approximately 76.3% of the State Budget (APBN) […]

Lets Move Indonesia

01/02/2025