This may seem like a relatively easy task in comparison to branding, website building, developing your own unique product etc; however, setting up a business in Indonesia can be extremely tricky and time consuming.

In this article Ricko Astono, Lets Move Indonesia’s in-house Company Establishment Specialist answers some of your most commonly asked questions about everything you need to know about company establishment in Indonesia.

What are the different business structures available in Indonesia?

There are a few possible ways to do this depending on your nationality and business model. If you are a foreigner, the best option is to set up a PT PMA. A PMA allows the foreigner to possess 100% ownership of the business.

If you are Indonesian or have Indonesian partners, you may obtain a Local PT whereby the ownership will be 100% Indonesian-owned.

Please note that with some industries, foreign ownership is not allowed, so you may have to establish a Local PT.

In addition, you may find information regarding which business sectors can be owned by foreign investors in the Negative Investment List (latest revision done through Presidential Regulation No. 44/2016). If the sector requires partial domestic ownership, then you will need a local partner. Business fields which are not included in the Negative Investment List are 100% open for foreign investment unless regulated differently in other regulations.

If you are unsure whether your business field falls under PMA guidelines, please feel free to contact me for advice.

What is PT?

In Indonesia, “PT” stands for “Perseroan Terbatas”, which translates to “Limited Liability Company” in English. It is the most common type of legal entity for businesses in Indonesia, especially for foreign investors seeking to establish a presence in the country.

Limitations to choose a business name

In Indonesia, you must register your company name in Indonesian using a minimum of 3 words. For example Klub Rumah Baru. But, don’t worry this is just your company establishment name, you may brand your business with an English name if you prefer.

When setting up a business do you need to register an actual office or can you use a residential location?

Before processing of incorporation, you need to choose the location of your business and have a registered address in an office building in Indonesia. You cannot use your home address as it is not possible to register a company with a residential address. Alternatively, you can also use a virtual office for Local PT or Coworking Space for PT PMA.

What is paid-up capital and how does that effect the business set-up?

Paid-up capital is the actual amount of money a shareholder invests into the business. This amount directly impacts the type of company you can establish (PT or PT PMA) and its classification based on size.

There are two ways to demonstrate paid-up capital:

- Bank Statement: Provide a copy of your company bank statement showing the invested amount.

- Statement Letter: Sign a statement letter declaring your intent to invest the required capital in the future.

Paid-up Capital Requirements:

PT (Perseroan Terbatas):

- Micro: No minimum paid-up capital requirement

- Small: Above IDR 50,000,000 – IDR 500,000,000

- Medium: Above IDR 500,000,000 – IDR 10,000,000,000

- Large: Above IDR 10,000,000,000

Important: To employ foreigners in a PT, the company size must be at least Medium with a paid-up capital exceeding IDR 2,500,000,000.

PT PMA (Foreign-Owned Company):

- Investment Plan: Must be at least USD 200,000 or equivalent in Rupiah (approximately IDR 2,9 billion based on current exchange rates). This can include cash or fixed assets like machinery.

- Paid-up Capital: Must be at least 25% of the Investment Plan, which translates to a minimum of USD 50,000 or equivalent in Rupiah.

Key Points about Company Structure:

- Minimum Shareholders: Both PT and PT PMA require a minimum of two shareholders.

- Commissioner and Director: At least one commissioner and one director are mandatory for both PT and PT PMA.

- Shareholder Types: Shareholders can be individuals, legal entities (corporations), or a combination of both.

Do you need to provide proof of transfer of your paid up capital?

Whilst processing our company establishment, you do not need to provide proof of transfer for your paid up capital. You may pay the paid up capital once the company is established.

What licenses and permits do I need to start a business in Indonesia?

The required licenses and permits vary based on your business activities. Common ones include:

- Nomor Induk Berusaha (NIB): A Single Business Identification Number that serves as the primary license for businesses in Indonesia.

- Company Domicile Certificate (Surat Keterangan Domisili Perusahaan/SKDP): Proof of your business address.

- Business License (Izin Usaha): Specific licenses might be needed depending on your industry (e.g., food handling, trading, etc.).

- Taxpayer Registration Number (Nomor Pokok Wajib Pajak/NPWP): For fulfilling tax obligations.

Are there any standard compliances you need to know before establishing your company in Indonesia?

Apart from taxes, companies must also register for social and health security programmes (BPJS) by the government. For PT PMA companies it is mandatory to report investment four times per year which is commonly known as the “LKPM Report”.

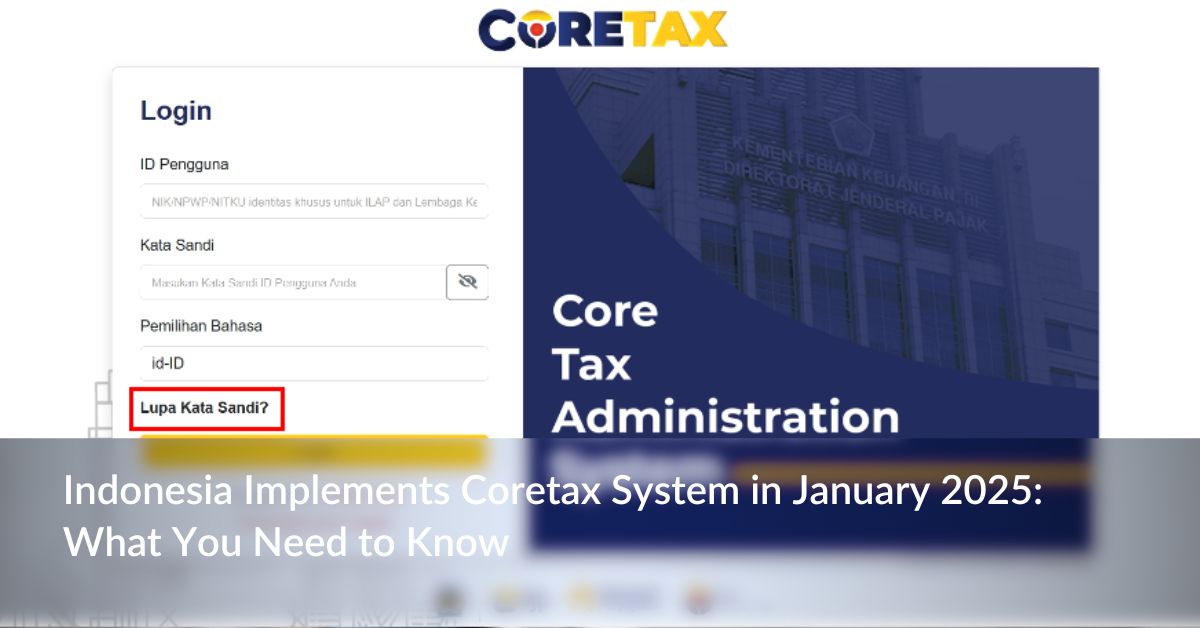

How does the business tax process work in Indonesia?

All companies in Indonesia must pay and report taxes on a monthly and annual basis. The main corporate taxes imposed on companies in Indonesia are: corporate income tax (CIT), value-added tax (VAT), and land and building tax. The general corporate income tax rate imposed in Indonesia is 25%. Medium-sized companies with annual revenue of less than IDR 50 billion can apply for a reduced income tax rate of 12.5%, and small companies with annual revenue of less than IDR 4.8 billion are eligible for corporate income tax of 0.5%.

Can the Director or Commissioner be a foreigner in a PT or a PMA?

Directors and Commissioners of a PT PMA can be foreigners or Indonesians and they are not required to be residents in Indonesia. Please note that non-resident Directors will not have the authority to sign documents on behalf of the company.

In regard to a Local PT, you may have a foreign Director, but you should still have a minimum of 1 local Director as well as a local commissioner.

How many foreigners can you hire once the company has been established?

A PT PMA may hire as many foreigners as required, as long as you have a minimum of 10 Indonesian Employees per 1 foreigner.

For a Local PT, you can hire 1 foreigner as long as you have a minimum paid-up capital of 10 billion IDR.

What are the responsibilities of the Director and the Commissioner?

The Directors’ responsibilities are to manage the company pursuant to its Articles of Association and the Indonesian Company Law.

The Commissioner’s responsibilities will be to supervise the company’s activities.

Once the company is established, do you need to renew any licenses every year?

There are no validity restrictions or renewals that are mandatory every year, as long as the company is still running and there are no amendments required from either the business structure or new governmental regulations.

If we would like to change the office address later is this possible?

If you would like to change your office location, the first thing you need to know is whether your new address is still in the same district as the previous one. If this is the case, then all you will be required to do is report your new company address to the tax office so they can change your taxation number.

Unfortunately, if your new address is in a different district you will need to amend numerous documents and permits such as: the location permit which will need to be signed by the district and subdistrict heads, as well as revise your Article of Association, Domicile Letter, Business License, Company Certificate Number and finally – advise the tax office so they that change your taxation account.

More about company establishment in Indonesia

I am starting a small business in Indonesia. What are the simplest legal structures available?

For small businesses, the simplest legal structures are typically:

- Perusahaan Perseorangan (Sole Proprietorship): This is the easiest and cheapest option, but you have unlimited personal liability for business debts.

- Usaha Dagang (UD) or Firma (Partnership): Suitable for businesses with multiple owners, offering shared responsibility and resources. However, partners have unlimited liability.

- Commanditaire Vennootschap (CV): A partnership with two types of partners: active partners (unlimited liability) and silent partners (limited liability to their investment).

Can I open a business bank account as a foreigner in Indonesia?

Yes, you can open a business bank account as a foreigner, but it might require additional documentation compared to Indonesian citizens. You’ll typically need:

- Valid passport and visa

- Proof of business registration (e.g., NIB)

- Company domicile certificate

- Other documents as requested by the bank

Register Your Business With Lets Move Indonesia

If you’re ready to take the plunge and set up your business in Indonesia, or even if you’re just exploring the idea and want some expert guidance, don’t hesitate to reach out to us. Lets Move Indonesia is here to help you navigate the complexities of company establishment, business licensing, and more. Our team of experienced professionals can provide you with the insights and support you need to turn your entrepreneurial dreams into reality.

Whether you have specific questions about the process or simply want to discuss your business ideas, we offer free consultations to help you get started on the right foot. Let us be your trusted partner in establishing a successful business presence in Indonesia. Contact Lets Move Indonesia today and let’s make your business journey a smooth and successful one.