Understanding each bank’s information is crucial when choosing a bank for your financial needs, making informed financial decisions, and safeguarding your assets, especially when you want to apply for a mortgage in this country.

It’s advisable to research and compare different banks based on factors such as reputation, services offered, fees, interest rates, customer reviews, and the convenience of their banking channels to find the institution that best meets your requirements.

Here is the list of banks that have a partnership with LetsMoveIndonesia, that will help you to find a mortgage for your desired property:

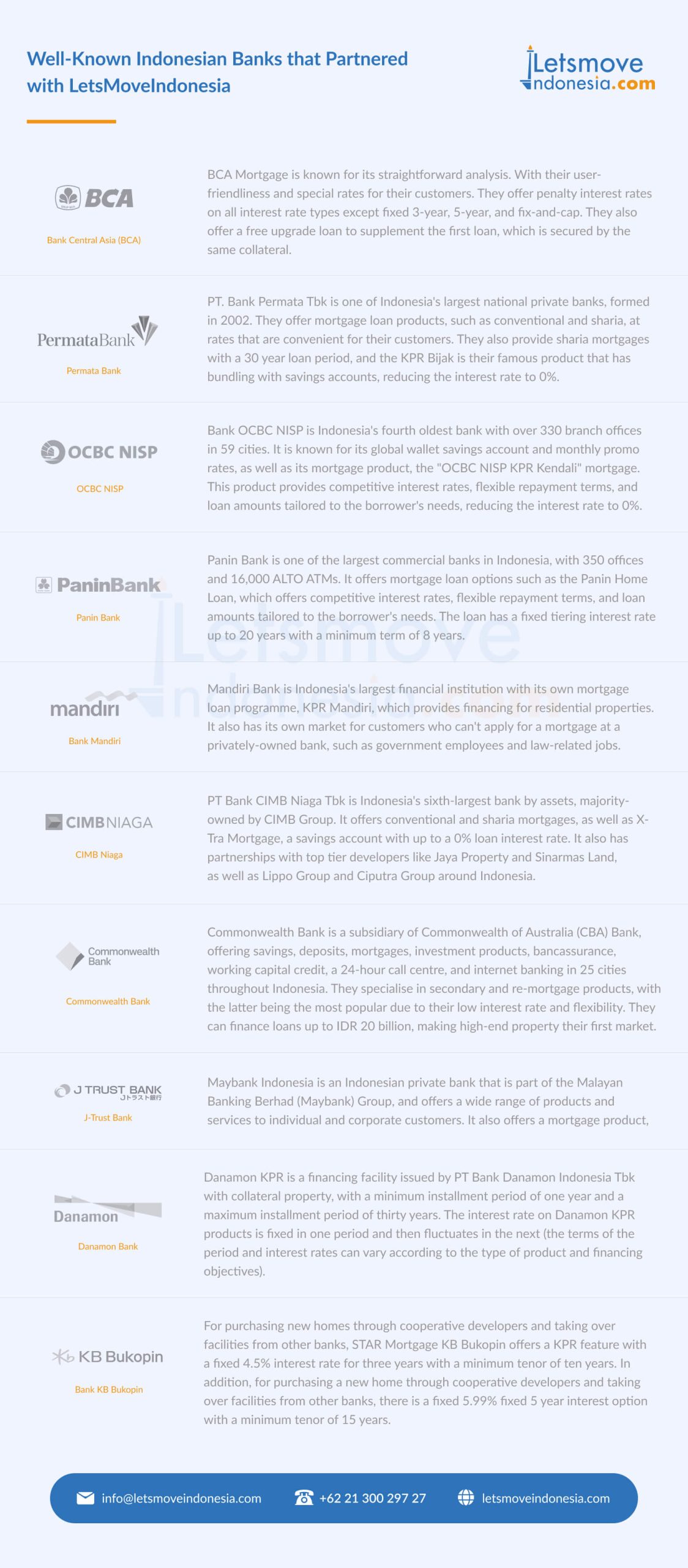

Well-Known Indonesian Banks that Partnered with LetsMoveIndonesia

Bank Central Asia (BCA)

PT Bank Central Asia Tbk (BCA) is the largest lender in Indonesia and the second largest bank by assets. It has over 1,000 branches across the country and offers both commercial and personal banking services. The Djarum Group, one of Indonesia’s largest conglomerates, owns a portion of BCA.

BCA provides a variety of loan products to meet a variety of needs and requirements, ranging from a credit card to a mortgage loan. If you have a BCA Savings Account, their mortgage loan product is well-known for its simplicity of analysis.

Permata Bank

Bank Permata Tbk (Permata Bank) is one of Indonesia’s largest national private banks. It was formed in 2002 as a result of a merger of five banks, and in 2004 it was taken over by two large companies, Standard Chartered Bank and PT. Astra International Tbk., which implemented a series of transformation programmes to strategically strengthen the company.

Permata Bank has over 2 million customers in 60 cities throughout Indonesia and has over 350 branch offices and the largest ATM network. They also provide mortgage loan products, such as conventional and sharia, at rates that are convenient for their customers.

OCBC NISP

Bank OCBC NISP (formerly known as Bank NISP) is Indonesia’s fourth oldest bank. It has over 330 branch offices in 59 cities and is well-known for its global wallet savings account and monthly promo rates.

They also have a well-known mortgage product known as the “OCBC NISP KPR Kendali” mortgage, which was created to provide financing for the purchase of residential properties. It usually provided competitive interest rates, flexible repayment terms, and loan amounts that were tailored to the borrower’s needs.

Panin Bank

Panin Bank, founded in 1971, is one of the largest commercial banks in Indonesia, ranking seventh in terms of total assets and capital. It has nearly 350 offices in various major cities throughout Indonesia, as well as over 16,000 ALTO ATMs.

To meet the needs of homebuyers, Panin Bank has provided various mortgage loan options, such as the Panin Home Loan, which provides financing for the purchase of residential properties. The loan offered competitive interest rates, flexible repayment terms, and loan amounts that could be tailored to the borrower’s needs and financial capacity.

Bank Mandiri

Mandiri Bank is Indonesia’s largest financial institution, providing a wide range of banking products and services to its customers. With five overseas branch offices, one subsidiary, and seven remittance offices, it has one of the largest foreign exchange networks in Indonesia.

KPR Mandiri, or Kredit Pemilikan Rumah Mandiri, is a Bank Mandiri mortgage loan programme that provides financing for the purchase of residential properties for primary residences and investment purposes.

CIMB Niaga

PT Bank CIMB Niaga Tbk is Indonesia’s sixth-largest bank by assets, established in 1955. It is majority-owned by CIMB Group and is the third-largest mortgage provider in Indonesia.

It offers both conventional and sharia mortgages, as well as X-Tra Mortgage, a savings account with up to 0% interest. This product can be used for purchasing houses, apartments, shops, land, takeovers, renovations, refinancing, and top-ups.

Commonwealth Bank

Commonwealth Bank is a subsidiary of Commonwealth of Australia (CBA) Bank, Australia’s largest service provider, and a component of the Morgan Stanley Capital Global Index.

Savings, deposits, mortgages, investment products, bancassurance, working capital credit for SME and SDB, a 24-hour call centre, and internet banking with special features are available to customers in 25 cities throughout Indonesia.

Commbank mortgage is one of their well-known products, which specialises in both primary and secondary property, with the secondary and re-mortgage products being the most popular due to their low interest rate and flexibility.

Maybank

PT Bank Maybank Indonesia, Tbk, is an Indonesian private bank that is part of the Malayan Banking Berhad (Maybank) Group, one of ASEAN’s largest financial services groups.

Maybank Indonesia offers a wide range of products and services to individual and corporate customers through community financial services (retail banking and non-retail banking), global banking, and automotive financing via its subsidiaries.

Maybank Indonesia has 356 branches throughout Indonesia, one overseas branch (Mumbai, India), 22 mobile cash cars, and 1,033 ATMs linked to over 20,000 ATMs incorporated in ATM PRIMA, ATM BERSAMA, ALTO, and CIRRUS and linked to 3,500 Maybank ATMs in Singapore, Malaysia, and Brunei. Maybank is also known for its mortgage product, which provides loans throughout Indonesia.

J-Trust Bank

J-Trust Bank (formerly Bank Mutiara) is a limited liability company in Indonesia that provides banking and financial services. Its origins can be traced back to 1989, when Bank CIC was established. In 2015, the bank was sold to J-Trust Co. Ltd. and renamed after management changes and recovery efforts.

J-Trust Mortgage financing could finance the purchase of land and buildings for newly-purchased or second-hand property, in the form of houses, apartments, shophouses, or home offices and could be used for the purpose of house construction or house renovation.

J-Trust Bank is known as a Japanese national bank, but currently they are developing and opening their market to other citizens. The products that they offered were mostly the result of their partnership with Japan-affiliated, well-known developers in Indonesia like Sinarmas Land.

Danamon Bank

Bank Danamon was established on the 16th of July, 1956, as PT Bank Kopra Indonesia. This bank’s name was changed to PT Bank Danamon Indonesia in 1976. This bank was the first to pioneer foreign currency exchange in Indonesia, becoming the first foreign exchange bank in 1976, and its shares have been listed on the stock exchange since 1989.

Danamon KPR is a financing facility issued by PT Bank Danamon Indonesia Tbk with collateral property, with a minimum installment period of one year and a maximum installment period of thirty years. The interest rate on Danamon KPR products is fixed in one period and then fluctuates in the next (the terms of the period and interest rates can vary according to the type of product and financing objectives).

KB Bukopin Bank

KB Bukopin (formerly known as Indonesian Cooperative Commercial Bank and Bank Bukopin) is an Indonesian middle-class private bank that focuses on four sectors: SME, micro, consumer, and commercial. Bank Bukopin officially changed its name to KB Bukopin in February 2021. KB Bukopin’s shareholders as of September 2022 are KB Kookmin Bank (67%), the Indonesian Government through its subsidiary Danareksa – Asset Management Company (1.53%), and the general public (31.46%).

The STAR Mortgage programme, offered by PT Bank KB Bukopin Tbk (BBKP), is a housing loan (KPR) promotion with competitive interest rates. This programme represents KB Bukopin’s commitment to providing quick, easy, and low-cost financing for home ownership.

For purchasing new homes through cooperative developers and taking over facilities from other banks, STAR Mortgage KB Bukopin offers a KPR feature with a fixed 4.5% interest rate for three years with a minimum tenor of ten years. In addition, for purchasing a new home through cooperative developers and taking over facilities from other banks, there is a fixed 5.99% fixed 5 year interest option with a minimum tenor of 15 years.

LetsMoveIndonesia’s bank partnerships impact your desired mortgage

Furthermore, LetsMoveIndonesia’s extensive network of bank partners allows them to provide invaluable assistance in obtaining the mortgage required to purchase your desired property. Our extensive network ensures that we can meet your specific needs, making the process more convenient and tailored to your specifications.

LetsMoveIndonesia can guide you through the complexities of obtaining a mortgage, providing you with the financial support needed to make your dream property a reality by leveraging our expertise and relationships. Whether you are a first-time buyer or a seasoned investor, our diverse range of options and personalised approach will equip you to confidently navigate the real estate market and achieve your homeownership objectives.

Allow LetsMoveIndonesia to be your dependable partner in obtaining the mortgage you require.

Found this article interesting? Then check out our other useful articles about visas here!

Exploring Possibilities of The Expat Mortgage in Indonesia

Your Path to Property Ownership: Essential Steps for Obtaining Mortgage in Indonesia

Decoding Indonesian Mortgage Products: The Essential Guide for Homebuyers

Top Banks that Partnered with LetsMoveIndonesia for Mortgage

Get Your Desired Mortgage with LetsMoveIndonesia: What You Need to Know