- Home

- Tax Services

- LKPM Registration

LKPM Registration

Tax & Accountancy Services

- Share:

LKPM Registration – Who is it for and what are the benefits

Investment Activity Report (LKPM) is an obligation for every business actor as stipulated in Article 15 letter (c) of Law No. 25 of 2007 concerning Capital Investment Article 5 letter (c) and BKPM Regulation No. 5 of 2021 concerning Guidelines and Procedures for Risk-Based Business Licensing Supervision.

LKPM is a report on the progress of Investment realization and problems faced by Business Actors that must be made and submitted periodically (Article 1 point (20) of BKPM Regulation No. 5 of 2021) which are required to submit LKPM online are all Business Actors, except Micro Business Actors, Companies in the upstream oil and gas business sector, banking, non-bank financial institutions and insurance.

Submission of the Investment Activity Report (LKPM) is a requirement for companies investing more than IDR 500,000,000 (approx. USD 33,900). This includes all companies with foreign shareholders as the minimum capital requirement for such is IDR 2,500,000,000. The company must also have an Identification Number to Operate or Nomor Induk Berusaha (NIB).

However, this does not apply to the following:

- Finance companies

- Insurance companies

- Banking companies

- Companies in the oil and gas industry

- Companies with expired operating licenses

New companies also have to submit an investment activity report. Once the Online Single Submission (OSS) System issues the NIB to your company, you will have to start submitting the LKPM.

Common Questions

When should I do LKPM report?

LKPM reports should do periodically, There are 4 quarters for each report.

Quarter 1st : Investment Report from January – March, will be reported in April;

Quarter 2nd : Investment Report from April – June, will be reported in July;

Quarter 3rd : Investment Report July – September, will be reported in October ; and

Quarter 4th : Investment Report October – December, will be reported in January.

What are the most common key points included in the LKPM report?

The most common key points included in the LKPM report are investment, labor, production, partnership as well as other obligations realization and problems faced by business actors

What will happen if I don’t report LKPM for my company?

If a business actor does not report LKPM for their company, they will get administrative sanctions based on Article 47 paragraph (1) BKPM Regulation 5/2021) :

- Written or online warning

- Restriction of Business activities

- Suspension of business activities and or investment facilities

- Revocation of business activities and or investment licenses and or investment facilities

Why should we ask a consultant's help to report LKPM?

You need consultant service to doing this to avoid errors/ mistake in submitting the reports

What kind of business does not have to report LKPM?

If your company has an investment value less than Rp. 1.000.000.000 ( one billion rupiah ) or your company is in non bank financial institutions, insurance, banking a s well as upstream oil and gas sector also if your company has a Principle Permit ( IP- Izin Prinsip), Investment Registration ( PI – Pendaftaran Penanaman Modal) and/or an inactive or expired Business License ( IU- Izin Usaha ) thats means you don’t have obligation to make a LKPM report.

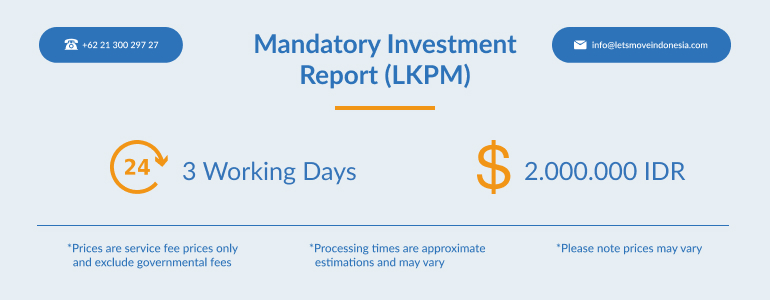

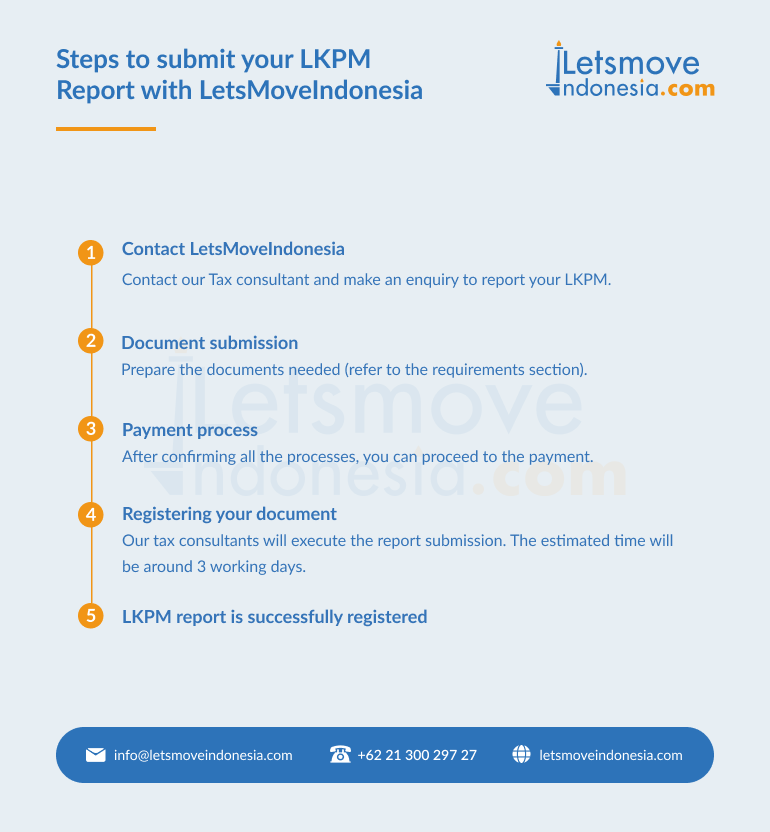

Steps to Report your LKPM with LetsMoveIndonesia

- Contact our Tax consultant and make an enquiry to report your LKPM

- Prepare the documents needed (refer to the requirements section)

- After confirming all the processes, you can proceed to the payment

- Our tax consultants will execute the report submission. The estimated time will be around 3 working days.

Requirements

You company must prepare all the documents below :

1. Identity and contact details of Company Directors:

2. Copy of Deed of Establishment along with Decree Approval from Ministry (SK)

- For Indonesian individuals, KTP, NPWP, email and phone number.

- For Foreign Individuals, valid passport, email and phone number.

3. Copy of Amendment of Article of Association along with Decree Approval from Ministry (if any)

4. Copy of Tax ID

5. Copy of Business License

6. Copy of Registration Number (NIB)

7. Financial Report for 3 Months

8. OSS Account Access

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

Indonesia’s tax system continues to play a pivotal role in supporting national development and achieving fiscal sustainability. However, enhancing tax revenue remains a significant challenge for the government, as annual targets consistently rise amidst various obstacles. As of 31 October 2024, Indonesia tax revenue reached IDR 1,517.5 trillion, approximately 76.3% of the State Budget (APBN) […]

Lets Move Indonesia

01/02/2025

If you plan to enjoy the wonders of Indonesia or conduct a short business trip to the country, the visa B211A might be something you are familiar with. This visa is valid for 60 days and is extendable for various purposes, making it a suitable choice for an ideal trip period. However, the 211 visa […]

Lets Move Indonesia

12/24/2024

If you’re planning frequent trips to Indonesia or considering a longer stay with flexibility to travel in and out, understanding Indonesia’s multiple-entry visa options may cut you a lot of hassle. This guide explores multiple-entry visas in Indonesia for 2024, including their eligibility, requirements, and latest updates. What is a Multiple Entry Visa? A multiple-entry […]

Lets Move Indonesia

12/24/2024

If you’re planning an extended stay in Indonesia, understanding the role of a visa sponsor is critical. Whether you’re looking to live in Bali or another part of the country, navigating the visa process is essential for ensuring a smooth experience. In this article, we’ll provide expert insights into the purpose of a visa sponsor, […]

Lets Move Indonesia

12/23/2024

For foreign tourists travelling to Bali from 2024 to 2025, the Bali Provincial Government has implemented a new requirement upon entry. The Bali Tourist Tax, also known as the Bali Tourism Levy effective 14 February 2024 and introduced for a fee of 150,000 IDR (approximately USD 10 or 9 EUR) for international visitors arriving on […]

Lets Move Indonesia

12/20/2024

Jakarta, 17 December 2024 – Indonesia has rolled out updated regulations on Non-Tax State Revenue (PNBP) for immigration services, including visa applications, stay permits, and passport issuance. These changes, outlined in Government Regulation No. 45 of 2024, officially take effect today, replacing the previous regulation, Government Regulation No. 28 of 2019. The revised PNBP rates […]

Lets Move Indonesia

12/17/2024